By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific Water Soluble Fertilizer Market has held the largest market share among the region in the Water Soluble Fertilizer Market. Asia-Pacific is the most populated region in the world, consisting of some of the major economies, including China, India, Japan and others. The growing innovations by major players operating in the region are likely to create huge opportunities for its market growth. For instance, in October 2020, Gujarat State Fertilizer and Chemicals India Ltd launched calcium nitrate and boronated calcium nitrate.

In agriculture, calcium nitrate is used as a water-soluble fertilizer. Additionally, this chemical is utilized to strengthen cement concrete as well as for wastewater treatment. Furthermore, in July 2018, Transworld Furtichem Pvt. Ltd, a significant fertilizer manufacturer in India, and Compo Expert Gmbh, a leading producer of specialty fertilizers for commercial use and a portfolio company of the international private equity firm XIO Group with its London headquarters, have agreed to a strategic partnership. Transworld Furtichem will cooperate with Compo Expert for the brands NovaTec and Basfoliar in India as a result of this extensive and forward-looking collaboration.

The development of new technologies, localization of production, and joint commercialization of the highly effective, ecologically friendly Compo Expert fertilizer products will be closely coordinated between the parties.

Apart from this, the recent export of various types of water-soluble fertilizer is set to boost its market growth. For instance, according to MRFR analysis, in 2021, India exported more than 84 thousand metric tonnes of nitrogenous fertilizers. The South Asian nation also exported 29.12 thousand metric tonnes of potash and 49.32 thousand metric tonnes of phosphate fertilizers that year. Furthermore, the prices of some water-soluble fertilizers were USD 1102.69/MT, including mono ammonium phosphate, potassium nitrate USD 1123.69/MT and urea phosphate were USD 984.54/MT.

The major countries studied are the US, Canada, Mexico, the UK, France, Germany, Italy, Spain, China, India, Japan, Australia and New Zealand, South America, the Middle East, and Africa.

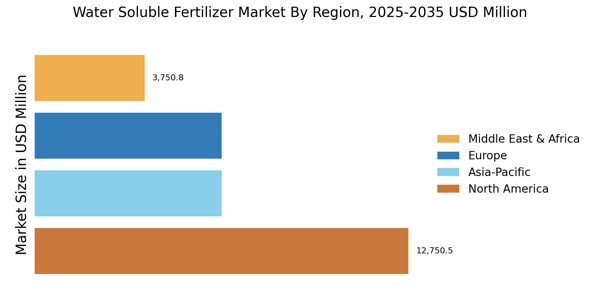

Figure 3: WATER SOLUBLE FERTILIZER MARKET SHARE BY REGION, 2022 & 2032 (USD Million)

The North American region includes major markets such as the US, Canada, and Mexico. The growing production of various types of fertilizer across the region such as potassium, ammonia, nitrogen and many more is set to positively influence its market growth. For instance, according to the International Fertilizer Association in 2020, ammonia was manufactured in the United States in 36 domestic plants, and it was transported throughout the nation by pipeline, rail, barge, and truck.

The United States produced 11.6% of the world's nitrogen in 2018, placing it second behind China, which produced 24.6% of it, and ahead of India, the third-largest producer with 11.3% of the world's supply. In terms of phosphate output, the U.S. came in second place with 9.9% of worldwide production, below China (37.7%), but ahead of India (9.8%), which generated 9.8% of the world's supply. Canada produced the most potassium potash, accounting for 31.9% of the world's supply. Belarus comes in second place, producing 16.5% of the world's supply.

In addition, the U.S. ranks seventh with a share of roughly 4.6% in nitrogen exports.

Europe basically includes the UK, Germany, France, Italy, Spain, and Rest of the Europe are all included in the analysis of the European market. Europe continues to hold a significant share in the global Water-Soluble Fertilizer market, owing to the presence of major players in the region coupled with the various strategies adopted by them to expand its product portfolio. For instance, in February 2022, EuroChem Group a leading worldwide fertilizer manufacturer announced that, after the submission of a legally binding bid, it has entered into an exclusive agreement to acquire the nitrogen business of the Borealis group.

In the centre of significant crop-producing regions in Austria and France, Borealis runs fertilizer production facilities. Borealis is one of Europe's top fertilizer manufacturers, supplying roughly four million tonnes of products annually in Western, Central, and South East Europe through the Borealis L.A.T distribution network, including approximately 0.08 million tonnes of technical nitrogen solutions and approximately 0.15 million tonnes of melamine. Apart from this, the recent government policies regarding fertilizer are expected to positively influence its market growth.

For example, in July 2019, European Union introduced a new regulation which intends to synchronize standards for all Member States and allow the free circulation of fertilizing products within the European Union.