Market Growth Projections

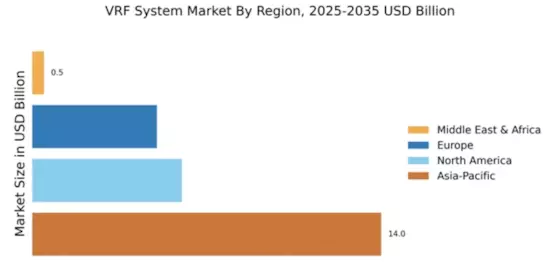

The Global VRF System Market Industry is poised for remarkable growth, with projections indicating a market size of 19.4 USD Billion in 2024 and an anticipated increase to 78.5 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 13.56% from 2025 to 2035, highlighting the increasing adoption of VRF technology across various sectors. The market's expansion is likely driven by factors such as energy efficiency, technological advancements, and regulatory support. As stakeholders recognize the benefits of VRF systems, the industry is expected to evolve, presenting new opportunities for manufacturers and service providers.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global VRF System Market Industry. The integration of smart technologies, such as IoT and advanced control systems, enhances the functionality and efficiency of VRF systems. These advancements allow for real-time monitoring and optimization of energy usage, which is increasingly appealing to both residential and commercial sectors. As the market evolves, manufacturers are likely to invest in research and development to introduce more sophisticated VRF solutions. This focus on innovation is expected to contribute to the market's growth trajectory, potentially reaching 78.5 USD Billion by 2035.

Rising Demand for Energy Efficiency

The Global VRF System Market Industry experiences a notable surge in demand driven by the increasing emphasis on energy efficiency. As energy costs continue to rise, consumers and businesses alike seek solutions that minimize energy consumption while maximizing comfort. VRF systems, known for their ability to provide precise temperature control and reduced energy usage, align well with these needs. In 2024, the market is projected to reach 19.4 USD Billion, reflecting a growing recognition of the benefits of VRF technology. This trend is likely to continue as more stakeholders prioritize sustainability and energy savings in their operational strategies.

Government Regulations and Incentives

Government regulations aimed at reducing carbon emissions and promoting energy-efficient technologies are driving the Global VRF System Market Industry. Many countries are implementing stringent standards for HVAC systems, encouraging the adoption of VRF technology. Incentives such as tax rebates and subsidies for energy-efficient installations further stimulate market growth. As governments worldwide recognize the importance of sustainable practices, the regulatory landscape is likely to become increasingly favorable for VRF systems. This supportive environment may lead to a broader acceptance of VRF technology across various sectors, enhancing its market presence.

Growing Awareness of Indoor Air Quality

The increasing awareness of indoor air quality (IAQ) issues is becoming a significant driver for the Global VRF System Market Industry. As health concerns related to air quality gain prominence, consumers are seeking HVAC solutions that not only provide comfort but also ensure clean air. VRF systems, equipped with advanced filtration and ventilation options, can effectively address these concerns. This growing focus on IAQ is likely to influence purchasing decisions, particularly in commercial spaces such as offices and schools. As a result, the demand for VRF systems may see substantial growth as stakeholders prioritize healthier indoor environments.

Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development significantly influences the Global VRF System Market Industry. As cities expand and new buildings emerge, there is a growing need for efficient heating and cooling solutions. VRF systems, with their modular design and flexibility, are well-suited for modern architectural demands. This trend is particularly evident in emerging economies, where urban centers are experiencing unprecedented growth. The increasing construction activities in these regions are likely to propel the demand for VRF systems, contributing to a compound annual growth rate of 13.56% from 2025 to 2035.