Rising Electric Vehicle Adoption

The surge in electric vehicle (EV) adoption is significantly influencing the energy storage-system-ess-battery-management-system-bms market. With projections indicating that EV sales in the US could reach 30% of total vehicle sales by 2030, the demand for efficient battery management systems is expected to escalate. These systems are crucial for optimizing battery performance, extending lifespan, and ensuring safety in EV applications. Furthermore, the development of vehicle-to-grid (V2G) technologies presents additional opportunities for energy storage solutions, as EVs can serve as mobile energy storage units. This evolving landscape suggests a robust growth trajectory for the energy storage-system-ess-battery-management-system-bms market, driven by the need for innovative battery management solutions.

Corporate Sustainability Initiatives

The increasing emphasis on corporate sustainability is driving the energy storage-system-ess-battery-management-system-bms market. Many companies in the US are setting ambitious sustainability goals, including achieving net-zero emissions. To meet these targets, businesses are investing in energy storage solutions that can enhance energy efficiency and reduce carbon footprints. The energy storage-system-ess-battery-management-system-bms market is likely to see growth as organizations seek to implement renewable energy systems paired with effective battery management technologies. In 2025, it is projected that corporate investments in sustainability initiatives will surpass $1 trillion, highlighting the potential for energy storage solutions to play a pivotal role in these efforts.

Enhanced Grid Stability Requirements

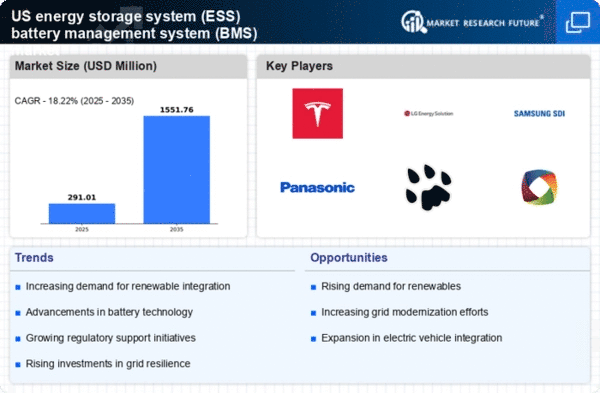

As the US grid faces increasing challenges related to stability and reliability, the energy storage-system-ess-battery-management-system-bms market is experiencing heightened demand. The need for grid operators to manage peak loads and provide ancillary services is becoming more critical. Energy storage systems equipped with advanced battery management technologies can offer solutions to these challenges by providing fast response times and supporting grid frequency regulation. In 2025, it is anticipated that investments in grid modernization will exceed $100 billion, further propelling the need for effective energy storage solutions. This trend indicates a growing recognition of the importance of battery management systems in maintaining grid stability and reliability.

Increasing Renewable Energy Integration

The integration of renewable energy sources, such as solar and wind, is a primary driver for the energy storage-system-ess-battery-management-system-bms market. As the US transitions towards a more sustainable energy grid, the demand for energy storage solutions that can effectively manage the intermittent nature of renewables is rising. In 2025, it is estimated that renewable energy sources will account for over 50% of the total electricity generation in the US. This shift necessitates advanced battery management systems to optimize energy storage and ensure reliability. The energy storage-system-ess-battery-management-system-bms market is thus positioned to benefit from this trend, as utilities and businesses seek to enhance their energy resilience and reduce reliance on fossil fuels.

Technological Innovations in Energy Storage

Technological innovations are reshaping the energy storage-system-ess-battery-management-system-bms market. Advances in battery chemistry, such as solid-state batteries and lithium-sulfur technologies, are enhancing energy density and safety. These innovations are crucial for applications ranging from grid storage to consumer electronics. The energy storage-system-ess-battery-management-system-bms market is expected to benefit from these developments, as improved battery technologies require sophisticated management systems to optimize performance and longevity. In 2025, the market for advanced battery technologies is projected to grow at a CAGR of 15%, indicating a robust demand for innovative battery management solutions that can support these new technologies.