Market Growth Projections

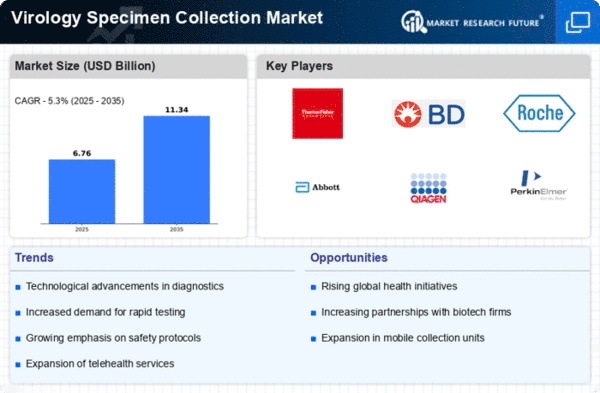

The Global Virology Specimen Collection Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 6.42 USD Billion in 2024 and further escalate to 11.3 USD Billion by 2035, the industry is poised for a robust expansion. The compound annual growth rate (CAGR) of 5.31% from 2025 to 2035 indicates a sustained upward trajectory, driven by factors such as technological advancements, increased demand for testing, and enhanced government support. This growth reflects the critical role of specimen collection in addressing global health challenges and improving disease management.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is influencing the Global Virology Specimen Collection Market Industry, as healthcare providers seek tailored treatment approaches based on individual patient profiles. This trend necessitates precise specimen collection methods to ensure accurate diagnostics and treatment plans. As healthcare systems increasingly adopt personalized strategies, the demand for high-quality specimens is expected to rise. This evolution in medical practice underscores the importance of reliable specimen collection, which is essential for the successful implementation of personalized therapies. Consequently, this focus on individualized care may drive market expansion in the coming years.

Increased Government Initiatives and Funding

Government initiatives aimed at improving public health infrastructure are significantly impacting the Global Virology Specimen Collection Market Industry. Increased funding for virology research and specimen collection programs is being observed globally, as governments recognize the importance of preparedness against viral outbreaks. This financial support facilitates the development of better collection protocols and training for healthcare professionals. Furthermore, public health campaigns are raising awareness about the importance of specimen collection in disease management. Such initiatives are likely to bolster market growth, as they enhance the capacity for effective viral surveillance and response.

Rising Demand for Infectious Disease Testing

The Global Virology Specimen Collection Market Industry is experiencing heightened demand for infectious disease testing, driven by the increasing prevalence of viral infections. As healthcare systems worldwide prioritize early detection and diagnosis, the market is projected to reach 6.42 USD Billion in 2024. This surge is indicative of a broader trend towards proactive healthcare measures, where timely specimen collection plays a crucial role in managing outbreaks and ensuring public health safety. Enhanced awareness among populations regarding viral diseases further fuels this demand, suggesting a sustained growth trajectory for the industry.

Emerging Markets and Global Health Initiatives

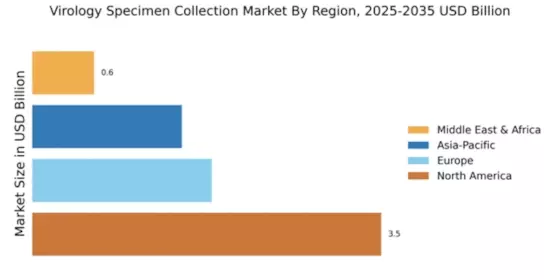

Emerging markets are playing a pivotal role in the Global Virology Specimen Collection Market Industry, as global health initiatives aim to enhance disease surveillance and response capabilities. Countries in regions such as Africa and Southeast Asia are receiving increased attention due to their vulnerability to viral outbreaks. International collaborations and funding are being directed towards improving specimen collection infrastructure in these areas, which is crucial for effective disease monitoring. As these markets develop their healthcare systems, the demand for virology specimen collection is likely to grow, contributing to the overall expansion of the industry.

Technological Advancements in Collection Methods

Technological innovations are transforming the Global Virology Specimen Collection Market Industry, with advancements in collection methods enhancing efficiency and accuracy. Novel devices and automated systems are being developed to streamline specimen collection processes, thereby reducing the risk of contamination and improving sample integrity. For instance, the introduction of self-collection kits has empowered patients to participate in their own healthcare, potentially increasing testing rates. As these technologies continue to evolve, they are likely to contribute to the market's growth, which is expected to reach 11.3 USD Billion by 2035, reflecting a robust CAGR of 5.31% from 2025 to 2035.