Rising Pet Ownership

The Global Veterinary Medicine Market Industry is experiencing growth driven by an increase in pet ownership worldwide. As more households adopt pets, the demand for veterinary services and products rises. In 2024, the market is projected to reach 36.20 USD Billion, reflecting the growing commitment of pet owners to ensure the health and well-being of their animals. This trend is particularly evident in urban areas where pet ownership rates have surged. The increasing awareness of pet health issues further propels the need for veterinary care, thereby expanding the market's potential.

Regulatory Support and Standards

The Global Veterinary Medicine Market Industry benefits from supportive regulatory frameworks and standards that ensure the safety and efficacy of veterinary products. Government agencies are actively involved in establishing guidelines that promote best practices in veterinary medicine. This regulatory environment not only fosters innovation but also instills confidence among pet owners regarding the quality of veterinary services. As regulations evolve to accommodate new technologies and treatments, the market is likely to see increased investment and development. This supportive landscape is essential for the continued growth and sustainability of the veterinary medicine sector.

Growing Awareness of Animal Health

The Global Veterinary Medicine Market Industry is bolstered by a heightened awareness of animal health and welfare among pet owners. Educational campaigns and initiatives by veterinary associations are effectively informing the public about the importance of regular veterinary care. As a result, pet owners are more inclined to seek veterinary services, contributing to market expansion. The increasing availability of information through digital platforms further enhances this awareness, allowing pet owners to make informed decisions regarding their pets' health. This trend is expected to sustain market growth as more individuals recognize the value of veterinary medicine.

Increased Focus on Preventive Care

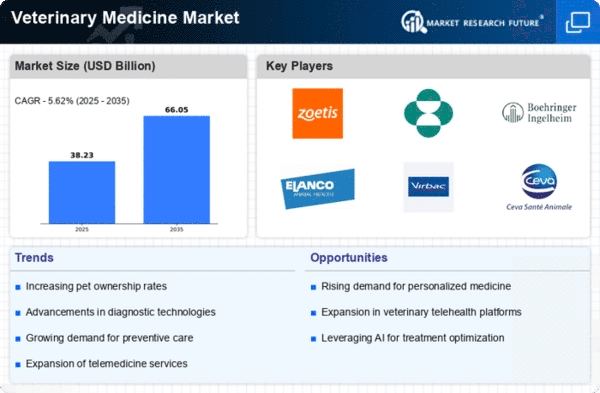

The Global Veterinary Medicine Market Industry is witnessing a shift towards preventive care, which is reshaping veterinary practices. Pet owners are increasingly prioritizing regular check-ups, vaccinations, and wellness programs to prevent diseases rather than solely seeking treatment. This proactive approach is likely to enhance the overall health of pets, thereby increasing the demand for veterinary services. The market is expected to grow at a CAGR of 5.62% from 2025 to 2035, indicating a sustained interest in preventive care solutions. This trend not only benefits pet health but also fosters long-term relationships between veterinarians and pet owners.

Advancements in Veterinary Technology

Technological innovations are significantly influencing the Global Veterinary Medicine Market Industry. The integration of advanced diagnostic tools, telemedicine, and electronic health records enhances the efficiency and effectiveness of veterinary practices. These advancements not only improve patient outcomes but also streamline operations within veterinary clinics. As the industry adapts to these technologies, it is likely to attract more clients seeking modern and efficient care for their pets. The ongoing development of veterinary pharmaceuticals and biologics also contributes to market growth, as these innovations address a wider range of health issues.