Technological Advancements in Imaging Techniques

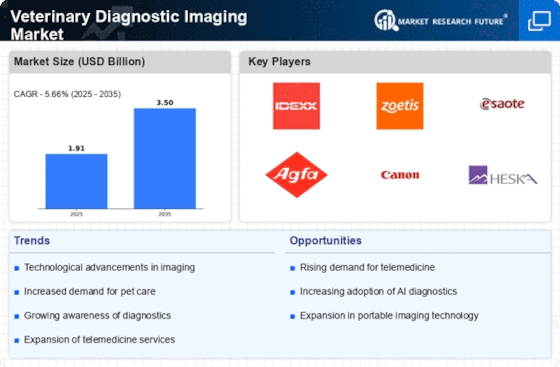

The Veterinary Diagnostic Imaging Market is experiencing a surge in technological advancements that enhance imaging techniques. Innovations such as high-resolution ultrasound, digital radiography, and advanced MRI systems are becoming increasingly prevalent. These technologies not only improve diagnostic accuracy but also reduce the time required for imaging procedures. For instance, the introduction of portable ultrasound devices allows for on-site diagnostics, which is particularly beneficial in rural areas. The market for veterinary imaging equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This growth is driven by the need for more precise diagnostics and the increasing adoption of advanced imaging modalities in veterinary practices.

Integration of Telemedicine in Veterinary Practices

The integration of telemedicine into veterinary practices is reshaping the Veterinary Diagnostic Imaging Market. Telemedicine facilitates remote consultations, allowing veterinarians to assess imaging results without the need for in-person visits. This trend is particularly advantageous for pet owners in remote locations, as it expands access to specialized veterinary care. The market is witnessing a rise in platforms that enable veterinarians to share diagnostic images and receive expert opinions from specialists. As a result, the demand for imaging services is likely to increase, as more veterinarians adopt telemedicine solutions. This shift not only enhances the efficiency of veterinary practices but also contributes to improved patient outcomes, thereby driving growth in the veterinary diagnostic imaging sector.

Rising Pet Ownership and Spending on Veterinary Care

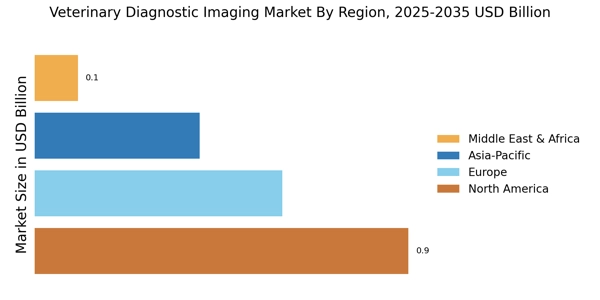

The Veterinary Diagnostic Imaging Market is benefiting from the rising trend of pet ownership and increased spending on veterinary care. As more households adopt pets, the demand for veterinary services, including diagnostic imaging, is on the rise. Recent statistics indicate that pet owners are willing to invest more in their pets' health, with expenditures on veterinary services increasing annually. This trend is particularly evident in urban areas, where pet owners seek advanced diagnostic options to ensure the well-being of their animals. Consequently, veterinary practices are expanding their imaging capabilities to meet this growing demand, which is expected to further propel the market for diagnostic imaging technologies.

Regulatory Support and Standards for Veterinary Imaging

The Veterinary Diagnostic Imaging Market is also shaped by regulatory support and the establishment of standards for veterinary imaging practices. Regulatory bodies are increasingly recognizing the importance of high-quality imaging in veterinary diagnostics, leading to the development of guidelines that ensure safety and efficacy. Compliance with these standards not only enhances the credibility of veterinary practices but also encourages the adoption of advanced imaging technologies. As regulations evolve, veterinary practices are likely to invest in state-of-the-art imaging equipment to meet compliance requirements. This regulatory support is expected to foster innovation and drive growth in the veterinary diagnostic imaging market, as practices strive to provide the best possible care for their patients.

Emphasis on Preventive Healthcare in Veterinary Medicine

The Veterinary Diagnostic Imaging Market is increasingly influenced by the emphasis on preventive healthcare in veterinary medicine. Veterinarians are advocating for regular check-ups and early detection of health issues, which often necessitates the use of diagnostic imaging. This proactive approach not only helps in identifying potential health problems before they escalate but also fosters a culture of responsible pet ownership. As pet owners become more aware of the benefits of preventive care, the demand for imaging services is likely to rise. This trend is expected to drive growth in the veterinary diagnostic imaging market, as practices invest in advanced imaging technologies to support preventive health initiatives.