Aging Population

The demographic shift towards an aging population is poised to have a profound impact on the Diagnostic Imaging Market. As individuals age, the likelihood of developing health issues increases, leading to a higher demand for diagnostic imaging services. It is estimated that by 2030, the number of people aged 60 and older will reach 1.4 billion, creating a substantial need for effective diagnostic tools. This demographic trend is likely to drive the adoption of imaging technologies, as older adults often require regular screenings and evaluations for various health conditions. The Diagnostic Imaging Market may experience growth in sectors such as ultrasound and X-ray imaging, which are frequently utilized in geriatric care. Thus, the aging population is a critical factor influencing the expansion of the market.

Technological Innovations

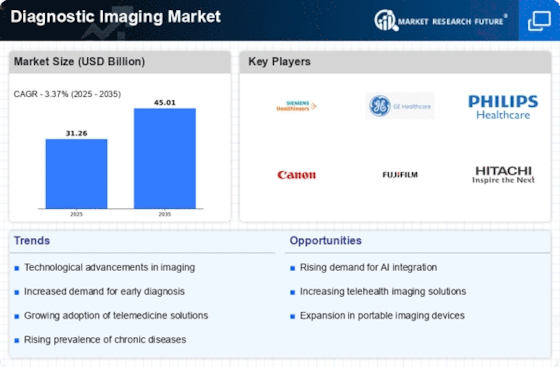

Technological innovations in imaging modalities are transforming the Diagnostic Imaging Market. Advancements such as 3D imaging, portable ultrasound devices, and enhanced MRI techniques are revolutionizing diagnostic capabilities. These innovations not only improve the accuracy of diagnoses but also enhance patient comfort and reduce examination times. For instance, the introduction of hybrid imaging technologies, which combine different imaging modalities, is gaining traction among healthcare providers. The market for these advanced technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years. As healthcare facilities strive to provide high-quality care, the integration of cutting-edge imaging technologies is likely to be a key driver of growth in the Diagnostic Imaging Market.

Increased Healthcare Expenditure

The rise in healthcare expenditure across various regions is a significant driver of the Diagnostic Imaging Market. Governments and private sectors are allocating more resources towards healthcare infrastructure, which includes investments in diagnostic imaging technologies. Recent data indicates that healthcare spending is expected to reach over 10 trillion dollars by 2025, reflecting a growing commitment to improving healthcare services. This increase in funding allows healthcare facilities to upgrade their imaging equipment and adopt new technologies, thereby enhancing diagnostic capabilities. The Diagnostic Imaging Market stands to benefit from this trend, as improved funding translates to greater access to advanced imaging services for patients. Consequently, the upward trajectory of healthcare expenditure is likely to stimulate market growth.

Growing Demand for Early Diagnosis

The growing emphasis on early diagnosis and preventive healthcare is a pivotal driver of the Diagnostic Imaging Market. Early detection of diseases significantly improves treatment outcomes and reduces healthcare costs. As awareness regarding the benefits of early diagnosis increases, healthcare providers are increasingly adopting advanced imaging technologies to facilitate timely interventions. The market for diagnostic imaging is projected to expand as more healthcare systems integrate imaging services into routine check-ups and screenings. This trend is particularly evident in cancer screening programs, where imaging plays a crucial role in identifying malignancies at an early stage. The Diagnostic Imaging Market is likely to experience sustained growth as the demand for early diagnosis continues to rise, reflecting a broader shift towards proactive healthcare management.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes is a primary driver of the Diagnostic Imaging Market. As these conditions require regular monitoring and precise diagnosis, the demand for advanced imaging technologies is likely to rise. According to recent statistics, chronic diseases account for approximately 70% of all deaths worldwide, necessitating enhanced diagnostic capabilities. This trend compels healthcare providers to invest in sophisticated imaging modalities, thereby propelling market growth. The Diagnostic Imaging Market is expected to witness a surge in demand for modalities like MRI and CT scans, which are essential for accurate disease detection and management. Consequently, the focus on chronic disease management is anticipated to significantly influence the market landscape.