Ethical Consumerism

Ethical consumerism is a driving force within the Vegan Fashion Market, as consumers increasingly seek products that reflect their values. This trend suggests that individuals are willing to pay a premium for fashion items that are cruelty-free and environmentally sustainable. Recent surveys indicate that a significant percentage of consumers prioritize ethical considerations when making purchasing decisions. This shift in consumer mindset is reshaping the market landscape, compelling brands to adopt transparent practices and ethical sourcing. The Vegan Fashion Market is responding to this demand by offering products that not only meet aesthetic desires but also align with ethical standards. As awareness of social and environmental issues continues to rise, the influence of ethical consumerism on purchasing behavior is likely to strengthen.

Diverse Product Offerings

The Vegan Fashion Market is characterized by an expanding array of product offerings, catering to a diverse consumer base. This diversification includes not only clothing but also accessories, footwear, and even vegan cosmetics. The increasing variety of products available suggests that brands are recognizing the need to appeal to different demographics and lifestyle preferences. Market data indicates that the demand for vegan alternatives in various fashion segments is on the rise, with consumers seeking stylish yet ethical options. This trend is likely to continue, as brands innovate and expand their collections to include a wider range of vegan products. The Vegan Fashion Market is thus becoming more inclusive, reflecting the diverse tastes and values of modern consumers.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Vegan Fashion Market. Innovations in production techniques, such as 3D printing and digital design, are enabling brands to create vegan products more efficiently and sustainably. These technologies not only reduce waste but also allow for greater customization, appealing to consumers who seek unique fashion items. Furthermore, advancements in material science are leading to the development of new vegan materials that mimic traditional fabrics without the associated ethical concerns. As these technologies continue to evolve, they are likely to enhance the competitiveness of the Vegan Fashion Market, attracting both consumers and investors. The integration of technology into fashion is thus a key driver of growth and innovation.

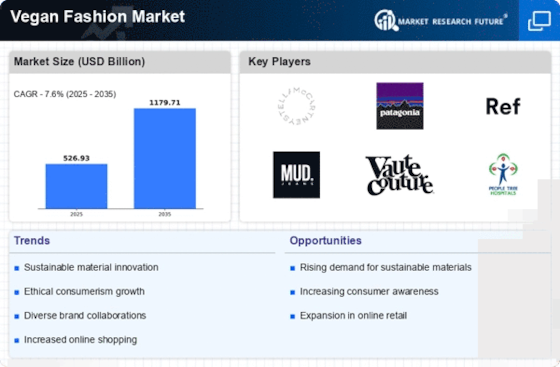

Sustainable Material Innovation

The Vegan Fashion Market is witnessing a surge in the development of sustainable materials, which are increasingly favored by consumers. Innovations such as plant-based leathers, recycled textiles, and biodegradable fabrics are gaining traction. According to recent data, the market for sustainable textiles is projected to reach substantial figures, indicating a growing preference for eco-friendly options. This shift is not merely a trend but appears to be a fundamental change in consumer behavior, as individuals become more aware of the environmental impact of their purchases. Brands that prioritize sustainable material innovation are likely to attract a dedicated customer base, thereby enhancing their market position. The Vegan Fashion Market is thus evolving, with a clear emphasis on materials that align with ethical and environmental values.

Increased Awareness of Environmental Impact

There is a growing awareness of the environmental impact of fashion, which is significantly influencing the Vegan Fashion Market. Consumers are becoming more informed about the detrimental effects of traditional fashion practices, such as pollution and resource depletion. This heightened awareness is driving a shift towards more sustainable and ethical fashion choices. Data suggests that a considerable portion of the population is actively seeking out vegan options as a means to reduce their ecological footprint. Brands that effectively communicate their commitment to sustainability are likely to resonate with this environmentally conscious consumer base. The Vegan Fashion Market is thus positioned to benefit from this trend, as more individuals prioritize eco-friendly fashion alternatives.

Leave a Comment