Global Economic Trends

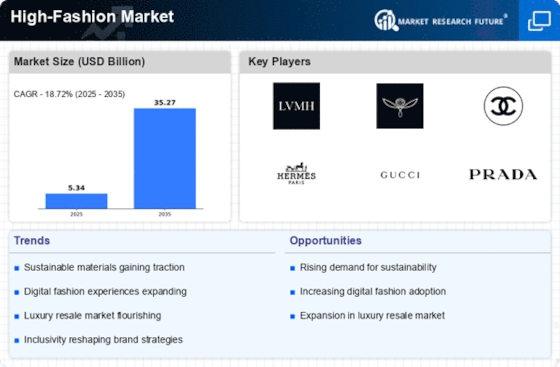

Global economic trends significantly impact the high-fashion Market, influencing consumer spending patterns and brand strategies. Economic growth in emerging markets is leading to an increase in disposable income, which in turn drives demand for luxury goods. In 2025, it is projected that the high-fashion sector will experience a 15% growth in these markets. Conversely, economic downturns in established markets may lead to a shift in consumer priorities, with a focus on value and quality over quantity. Brands must navigate these fluctuations by adjusting their pricing strategies and product offerings. The High-Fashion Market's ability to respond to economic changes will be crucial in maintaining its competitive edge and ensuring sustained growth.

Luxury Consumer Behavior

The behavior of luxury consumers is a critical driver in the High-Fashion Market. As wealth distribution shifts, a new generation of affluent consumers is emerging, characterized by their desire for unique and personalized experiences. In 2025, it is estimated that 70% of luxury purchases will be influenced by social media and online platforms. This demographic values exclusivity and is willing to invest in high-quality, limited-edition items. Brands are responding by creating bespoke offerings and enhancing their online presence to cater to this evolving consumer base. The High-Fashion Market must adapt to these changing preferences, ensuring that it remains relevant and appealing to the modern luxury consumer.

Sustainability Initiatives

The High-Fashion Market is increasingly influenced by sustainability initiatives, as consumers become more environmentally conscious. Brands are adopting eco-friendly materials and ethical production practices to appeal to this demographic. In 2025, it is estimated that 60% of consumers prioritize sustainability when making purchasing decisions. This shift is prompting high-fashion brands to innovate, leading to a rise in sustainable collections and collaborations with eco-conscious designers. The industry's commitment to reducing its carbon footprint is not only a response to consumer demand but also a strategic move to enhance brand loyalty and reputation. As sustainability becomes a core value, the High-Fashion Market is likely to witness a transformation in its supply chain dynamics, with a focus on transparency and accountability.

Technological Advancements

Technological advancements are reshaping the High-Fashion Market, with innovations in design, production, and retail. The integration of artificial intelligence and machine learning is streamlining operations, enabling brands to predict trends and optimize inventory management. In 2025, it is projected that 40% of high-fashion brands will utilize AI-driven analytics to enhance customer experiences. Additionally, augmented reality is becoming a vital tool for virtual try-ons, allowing consumers to engage with products in immersive ways. This technological evolution not only enhances efficiency but also fosters a deeper connection between brands and consumers. As the High-Fashion Market embraces these advancements, it is likely to attract a tech-savvy clientele, further driving growth and engagement.

Cultural Influences and Diversity

Cultural influences and diversity play a pivotal role in shaping the High-Fashion Market. As global connectivity increases, fashion brands are drawing inspiration from various cultures, leading to a rich tapestry of designs and styles. In 2025, it is anticipated that brands that celebrate diversity will see a 25% increase in market share. This trend reflects a broader societal shift towards inclusivity, with consumers seeking representation in fashion. Collaborations with diverse designers and the incorporation of multicultural elements into collections are becoming commonplace. The High-Fashion Market is thus evolving to reflect a more inclusive narrative, appealing to a wider audience and fostering a sense of belonging among consumers.