Focus on Miniaturization and Portability

The trend towards miniaturization and portability is reshaping The Global Vector Network Analyzer Industry. As industries seek more compact and versatile testing solutions, manufacturers are developing smaller, lightweight analyzers without compromising performance. This shift caters to the needs of field engineers and technicians who require portable solutions for on-site testing. The market for portable vector network analyzers is anticipated to grow, reflecting the industry's demand for flexibility and convenience. Furthermore, the integration of advanced technologies into smaller devices enhances their functionality, making them indispensable tools in various applications. This focus on miniaturization is likely to drive innovation within The Global Vector Network Analyzer Industry.

Growing Adoption in Aerospace and Defense

The aerospace and defense sectors are increasingly adopting vector network analyzers, which is positively influencing The Global Vector Network Analyzer Industry. The need for rigorous testing and validation of communication systems and radar technologies drives this demand. As these sectors prioritize reliability and performance, the use of vector network analyzers becomes essential for ensuring compliance with stringent standards. The market is projected to expand as defense contractors and aerospace manufacturers invest in advanced testing equipment to enhance their operational capabilities. This growing adoption signifies a robust opportunity for growth within The Global Vector Network Analyzer Industry, as it aligns with the increasing complexity of aerospace and defense technologies.

Rising Demand in Telecommunications Sector

The telecommunications sector is experiencing a surge in demand for vector network analyzers, significantly impacting The Global Vector Network Analyzer Industry. With the expansion of 5G networks and the increasing complexity of communication systems, the need for precise network analysis has become paramount. This sector is expected to account for a substantial share of the market, as companies seek to optimize network performance and ensure reliability. The growing number of connected devices and the push for higher data rates further amplify this demand. As a result, The Global Vector Network Analyzer Industry is likely to witness robust growth, driven by the telecommunications sector's evolving requirements.

Increased Investment in Research and Development

Investment in research and development is a critical driver for The Global Vector Network Analyzer Industry. Companies are allocating significant resources to innovate and enhance their product offerings, aiming to meet the evolving needs of various sectors. This focus on R&D leads to the introduction of advanced features, such as real-time analysis and enhanced user interfaces, which improve the overall user experience. As industries become more competitive, the emphasis on developing cutting-edge technologies is expected to intensify. This trend not only fosters growth within The Global Vector Network Analyzer Industry but also encourages collaboration between manufacturers and research institutions, further propelling advancements.

Technological Advancements in Measurement Techniques

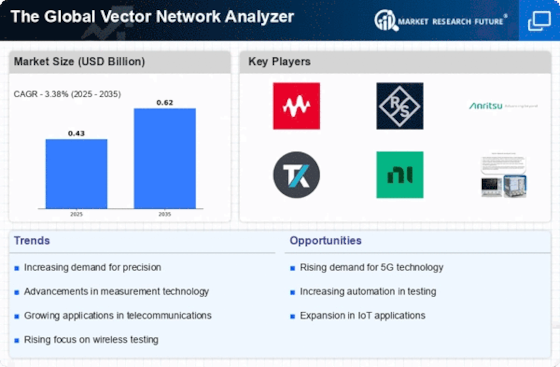

The evolution of measurement techniques plays a pivotal role in The Global Vector Network Analyzer Industry. Innovations such as enhanced algorithms and improved calibration methods have led to more accurate and efficient measurements. These advancements enable engineers to conduct complex analyses with greater precision, thereby increasing the demand for vector network analyzers. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these technological improvements. As industries increasingly rely on precise measurements for product development and quality assurance, the significance of advanced measurement techniques in The Global Vector Network Analyzer Industry cannot be overstated.