- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

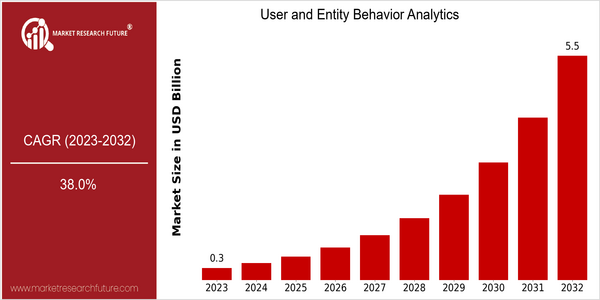

| Year | Value |

|---|---|

| 2023 | USD 0.28 Billion |

| 2032 | USD 5.49 Billion |

| CAGR (2024-2032) | 38.0 % |

Note – Market size depicts the revenue generated over the financial year

UEBA Market: UEBA Market is estimated to reach USD 5.49 billion by 2032. CAGR of 38.0% from 2024 to 2032. The market is expected to grow at a CAGR of 38.0% from 2024 to 2032. The growing sophistication and frequency of cyber attacks, the need for businesses to comply with the strict regulatory requirements, and the growing need for businesses to comply with the strict regulatory requirements are the main reasons for the expansion of the market. The technological developments, especially in artificial intelligence and machine learning, are also driving the UEBA market. These solutions help companies to detect unusual behavior of users and entities, thereby improving their threat detection capabilities. Various market players, such as Splunk, Sumo Logic, and Exabeam, are actively investing in new product developments and establishing strategic alliances to enhance their product offerings. Various recent collaborations aimed at integrating UEBA with existing security information and event management (SIEM) systems indicate the commitment of the industry to offer comprehensive security solutions. The increasing use of UEBA to protect digital assets will continue to increase in the coming years.

Regional Market Size

Regional Deep Dive

The User and Entity Behavior Analytics (UEBA) market is experiencing considerable growth in several regions, driven by the increasing need for advanced security solutions to counter the sophisticated cyber-threats. North America is characterized by high technology uptake and the presence of major players, while Europe is experiencing an increase in the regulatory compliances that are driving the need for enhanced security solutions. Asia-Pacific is experiencing high growth, primarily driven by the digital transformation and cloud adoption trends, which are boosting the demand for UEBA solutions. The Middle East and Africa are gradually realizing the importance of security, as the cyber-attacks are increasing, while Latin America is increasingly investing in the security analytics to protect its sensitive data.

Europe

- The General Data Protection Regulation (GDPR) has prompted organizations across Europe to adopt UEBA solutions to ensure compliance and protect user data, leading to increased investments in security analytics.

- Companies like Darktrace are leveraging AI-driven UEBA technologies to provide real-time threat detection and response, significantly enhancing the cybersecurity landscape in Europe.

Asia Pacific

- Countries like Singapore and Australia are investing heavily in cybersecurity initiatives, with government programs promoting the adoption of UEBA solutions to safeguard critical infrastructure and sensitive data.

- The rise of digital banking and e-commerce in the region has led to a surge in cyber threats, prompting organizations to implement UEBA solutions to monitor user behavior and detect anomalies.

Latin America

- The rise in cybercrime incidents in Brazil has led to a greater focus on cybersecurity measures, with companies beginning to adopt UEBA solutions to protect sensitive customer information.

- Government initiatives in countries like Mexico are promoting the development of cybersecurity frameworks, encouraging organizations to invest in advanced analytics for better threat detection.

North America

- The U.S. government has implemented the Cybersecurity Maturity Model Certification (CMMC), which emphasizes the need for advanced analytics solutions like UEBA to ensure compliance and enhance security postures among defense contractors.

- Major companies such as Splunk and Sumo Logic are continuously innovating their UEBA offerings, integrating machine learning and AI capabilities to improve threat detection and response times.

Middle East And Africa

- The UAE's National Cybersecurity Strategy emphasizes the importance of advanced analytics in combating cyber threats, leading to increased adoption of UEBA solutions among government and private sectors.

- Organizations in South Africa are increasingly recognizing the need for UEBA to address the growing number of cyber incidents, with local firms like SecureData investing in advanced analytics capabilities.

Did You Know?

“Did you know that organizations using UEBA solutions can reduce the time to detect and respond to security incidents by up to 90% compared to traditional methods?” — Gartner Research

Segmental Market Size

The market for UEBA solutions is currently experiencing strong growth, driven by the growing need for more sophisticated security measures in the enterprise. The main driving forces are the increase in sophisticated cyber attacks, which requires a proactive monitoring of the behavior of users and entities, and the increasingly stringent requirements of regulatory compliance. Also, the growing trend towards remote working increases the need for comprehensive security solutions that can be adapted to various environments. In the meantime, UEBA solutions are already being deployed on a large scale by the leading vendors such as Splunk, Sumo Logic and Exabeam in a wide range of industries, including finance and health. Fraud detection, insider threat detection and compliance monitoring are the main applications. Enterprises use these tools to protect sensitive data. Moreover, the growing frequency of data breaches and the trend towards zero-trust security models will further accelerate the market growth. Machine learning and artificial intelligence are key to UEBA solutions' functionality and enable enterprises to process large amounts of data efficiently.

Future Outlook

The market for the analysis of the behavior of users and entities will grow significantly between 2023 and 2032, from $281 million to $ 5,490 million, at a high CAGR of 38.0%. This explosive growth is due to the growing need for companies to increase their security in the face of new threats. This will lead to a higher penetration of the market for solutions that detect anomalies in the behavior of users and entities. In 2032, more than 60% of organizations will have UEBA solutions as part of their security framework, compared to about 15% in 2023. This will be a strong shift towards the detection of threats in advance. Also, technological developments, such as the integration of artificial intelligence and machine learning into UEBA systems, will further accelerate market growth. These new tools enable the real-time analysis of large amounts of data, which gives a much clearer picture of the behavior of users and the potential risks they face. Moreover, the regulatory framework relating to data protection and privacy will force companies to invest in UEBA solutions to comply with regulations such as the GDPR and the CCPA. Also, the increasing use of cloud services and the growing importance of remote work will boost the market for UEBA, as organizations seek to secure their digital environments against a changing operating environment. The UEBA market is thus undergoing a major transformation, driven by technological developments and the urgent need for increased security.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.2 Billion |

| Market Size Value In 2023 | USD 0.289 Billion |

| Growth Rate | 44.50% (2023-2032) |

User Entity Behavior Analytics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.