Rising Cybersecurity Threats

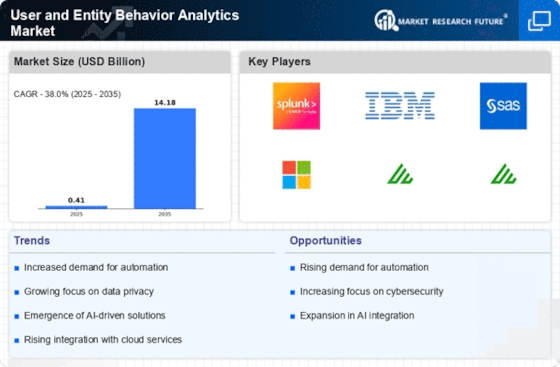

The User and Entity Behavior Analytics Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of advanced analytics to detect anomalies and potential breaches in real-time. According to recent data, cybercrime is projected to cost businesses trillions annually, prompting a shift towards proactive security measures. User and Entity Behavior Analytics (UEBA) solutions provide insights into user activities, enabling organizations to identify unusual patterns that may indicate malicious intent. This heightened awareness of cybersecurity risks is driving investments in UEBA technologies, as companies seek to safeguard sensitive information and maintain customer trust. As a result, the User and Entity Behavior Analytics Market is poised for substantial growth, with organizations prioritizing the implementation of robust analytics solutions to combat evolving threats.

Increased Regulatory Requirements

The User and Entity Behavior Analytics Market is significantly influenced by the growing landscape of regulatory compliance. Organizations are increasingly required to adhere to stringent regulations regarding data protection and privacy, such as GDPR and CCPA. These regulations necessitate the implementation of comprehensive monitoring and reporting mechanisms to ensure compliance. UEBA solutions offer organizations the capability to track user behavior and detect anomalies that may indicate non-compliance or data breaches. As regulatory bodies impose heavier penalties for violations, the demand for UEBA technologies is expected to rise. Companies are investing in these solutions not only to avoid fines but also to enhance their overall security posture. Consequently, the User and Entity Behavior Analytics Market is likely to see accelerated growth as organizations prioritize compliance-driven analytics.

Shift Towards Remote Work Environments

The User and Entity Behavior Analytics Market is experiencing a transformation due to the shift towards remote work environments. As organizations adapt to flexible work arrangements, the need for robust security measures has become paramount. Remote work introduces new vulnerabilities, making it essential for companies to monitor user behavior across various locations and devices. UEBA solutions enable organizations to track user activities and detect anomalies that may indicate security breaches in remote settings. This trend is driving the demand for analytics solutions that can provide visibility and control over user behavior, regardless of location. As remote work continues to be a prevalent model, the User and Entity Behavior Analytics Market is likely to see sustained growth, with organizations investing in technologies that enhance their security posture in a distributed work environment.

Growing Need for Insider Threat Detection

The User and Entity Behavior Analytics Market is increasingly driven by the need for effective insider threat detection. Organizations are becoming more aware that threats can originate from within, whether through malicious intent or unintentional actions. UEBA solutions provide the necessary tools to monitor user behavior and identify potential insider threats by analyzing patterns and deviations from normal activities. As insider threats can lead to significant financial and reputational damage, organizations are prioritizing the implementation of UEBA technologies to mitigate these risks. The market for insider threat detection is projected to grow substantially, as companies recognize the importance of safeguarding their assets from internal vulnerabilities. This growing focus on insider threat detection is likely to bolster the User and Entity Behavior Analytics Market.

Adoption of Advanced Analytics Technologies

The User and Entity Behavior Analytics Market is witnessing a notable shift towards the adoption of advanced analytics technologies. Organizations are increasingly leveraging machine learning and artificial intelligence to enhance their analytical capabilities. These technologies enable the processing of vast amounts of data, allowing for more accurate detection of anomalies and potential threats. The integration of advanced analytics into UEBA solutions is transforming how organizations approach security, providing deeper insights into user behavior. As businesses recognize the value of data-driven decision-making, the demand for sophisticated analytics tools is expected to grow. This trend is likely to propel the User and Entity Behavior Analytics Market forward, as organizations seek to harness the power of advanced technologies to improve their security frameworks.