Integration of Smart Features

The integration of smart features into wireless earphones is a significant driver in the market. As consumers increasingly adopt smart devices, the demand for earphones that can seamlessly connect and interact with these devices grows. Features such as voice assistants, touch controls, and health monitoring capabilities are becoming commonplace. The wireless earphone market is witnessing a shift towards multifunctional devices that enhance user experience. Recent statistics suggest that around 40% of consumers are willing to pay a premium for earphones equipped with smart technology. This trend not only reflects changing consumer preferences but also indicates a potential for growth in the market as manufacturers innovate to meet these expectations.

Enhanced Audio Quality Expectations

In the wireless earphone market, consumers increasingly expect superior audio quality, which significantly influences purchasing decisions. As technology advances, features such as noise cancellation, high-fidelity sound, and customizable audio profiles have become standard expectations. The wireless earphone market is responding to this demand by incorporating advanced audio technologies, such as aptX and LDAC, which facilitate high-resolution audio streaming. Market data indicates that approximately 60% of consumers prioritize sound quality over other features when selecting wireless earphones. This emphasis on audio excellence not only drives competition among manufacturers but also encourages continuous innovation in product development, ensuring that the wireless earphone market remains dynamic and responsive to consumer needs.

Rising Consumer Demand for Portability

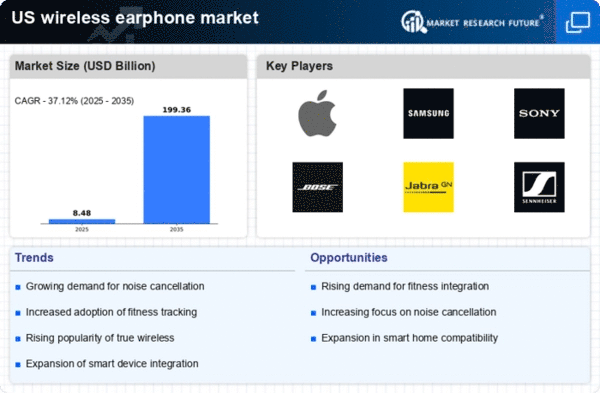

The wireless earphone market experiences a notable surge in consumer demand for portable audio solutions. As lifestyles become increasingly mobile, individuals seek lightweight and compact audio devices that can seamlessly integrate into their daily routines. This trend is particularly pronounced among younger demographics, who prioritize convenience and style. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for on-the-go audio experiences. The wireless earphone market is adapting to this demand by introducing innovative designs and features that enhance portability, such as foldable models and extended battery life. This shift towards portability not only caters to consumer preferences but also aligns with the broader trend of minimalism in personal technology.

Increased Focus on Fitness and Wellness

The wireless earphone market is experiencing a notable increase in focus on fitness and wellness, as consumers seek audio solutions that complement their active lifestyles. With the rise of fitness apps and wearable technology, there is a growing demand for earphones that offer features such as sweat resistance, secure fit, and integrated fitness tracking. The wireless earphone market is responding by designing products specifically tailored for athletes and fitness enthusiasts. Recent data indicates that around 50% of consumers consider fitness compatibility a crucial factor when purchasing wireless earphones. This trend not only drives innovation in product design but also expands the market reach, as manufacturers target health-conscious consumers looking for reliable audio solutions during workouts.

Growing Popularity of Streaming Services

The wireless earphone market is significantly influenced by the growing popularity of streaming services. As more consumers turn to platforms like Spotify and Apple Music for their audio needs, the demand for high-quality wireless earphones that enhance the listening experience increases. This trend is particularly evident among younger audiences who prioritize access to music on-the-go. The wireless earphone market is capitalizing on this shift by developing products that cater to streaming needs, such as earphones with extended battery life and superior connectivity. Market analysis shows that approximately 70% of consumers use wireless earphones primarily for streaming music, highlighting the importance of this driver in shaping product offerings and marketing strategies.