Health Consciousness Among Consumers

The growing awareness of health and wellness among consumers is a pivotal driver for the whey protein-ingredients market. As individuals increasingly prioritize nutrition, the demand for high-quality protein sources has surged. This trend is particularly evident in the fitness and sports nutrition sectors, where whey protein is favored for its complete amino acid profile. According to recent data, the market for protein supplements in the US is projected to reach approximately $5 billion by 2026, with whey protein accounting for a substantial share. This heightened focus on health is prompting manufacturers to innovate and offer products that align with consumer preferences for clean, natural ingredients, thereby propelling the whey protein-ingredients market forward.

Growth of the Sports Nutrition Sector

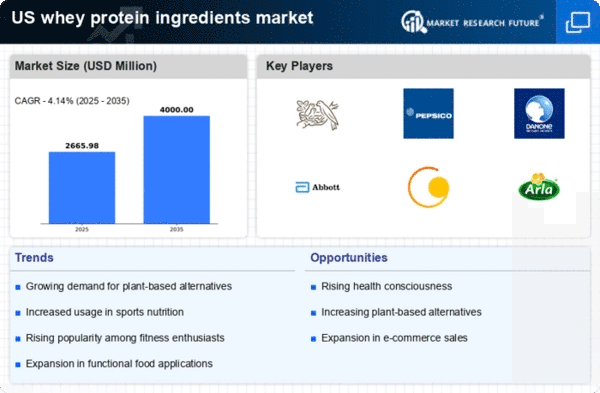

The expansion of the sports nutrition sector significantly influences the whey protein-ingredients market. With an increasing number of individuals engaging in fitness activities, the demand for protein supplements, particularly whey protein, has escalated. This market segment is expected to witness a compound annual growth rate (CAGR) of around 8% over the next few years. Athletes and fitness enthusiasts are increasingly turning to whey protein for its rapid absorption and muscle recovery benefits. Consequently, brands are launching innovative whey protein products tailored to this demographic, further stimulating growth in the whey protein-ingredients market. The alignment of product offerings with the needs of active consumers is likely to enhance market dynamics.

Rising Popularity of Plant-Based Diets

The increasing adoption of plant-based diets is reshaping the whey protein-ingredients market. While this trend may seem counterintuitive, many consumers are seeking to complement their plant-based diets with high-quality protein sources, including whey protein. This is particularly true among flexitarians who incorporate both plant and animal proteins into their diets. The market for whey protein is projected to grow as these consumers look for versatile protein options that can be easily integrated into smoothies, snacks, and meal replacements. The ability of whey protein to provide essential amino acids while appealing to health-conscious consumers positions it favorably within the evolving dietary landscape, thereby driving growth in the whey protein-ingredients market.

Technological Advancements in Production

Technological advancements in the production of whey protein are a crucial driver for the whey protein-ingredients market. Innovations in processing techniques, such as microfiltration and ultrafiltration, enhance the purity and quality of whey protein products. These advancements not only improve the nutritional profile but also cater to the increasing consumer demand for high-quality protein ingredients. As manufacturers adopt these technologies, they can produce whey protein with reduced lactose content, making it more accessible to lactose-intolerant individuals. This shift is likely to expand the consumer base and stimulate growth in the whey protein-ingredients market, as more products become available to meet diverse dietary needs.

Increased Investment in Research and Development

The heightened investment in research and development (R&D) within the whey protein-ingredients market is driving innovation and product diversification. Companies are focusing on developing new formulations that enhance the functional properties of whey protein, such as solubility and emulsification. This investment is crucial for meeting the evolving demands of consumers who seek functional foods that offer health benefits beyond basic nutrition. Furthermore, R&D efforts are likely to lead to the introduction of novel whey protein products that cater to specific dietary needs, such as gluten-free or low-sugar options. As a result, the whey protein-ingredients market is expected to benefit from a continuous influx of innovative products, thereby enhancing its competitive landscape.