US Transformer Market Summary

As per Market Research Future analysis, the US Transformer Market Size was estimated at 10491.58 USD Million in 2024. The Genset industry is projected to grow from 11264.78 USD Million in 2025 to 25389.26 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US Transformer Market is experiencing strong growth due to increasing demand for reliable and uninterrupted power supply across residential, commercial, and industrial sectors.

- Expansion of data centers, cloud computing, AI, and manufacturing facilities is boosting the need for high-capacity transformers that can ensure stable power and prevent downtime.

- Aging power infrastructure in the US is driving replacement and upgrading of transformers, especially in urban and industrial areas.

- Growing emphasis on energy efficiency, carbon emission reductions, and compliance with stringent regulations is encouraging utilities and industries to adopt modern, energy-efficient transformers.

- Despite demand, the market faces constraints from high manufacturing, operational, and maintenance costs of advanced transformers, including smart and high-voltage units.

- Innovations in smart transformers, IoT-enabled monitoring, and predictive maintenance are accelerating transformer adoption in the US by improving reliability and operational efficiency.

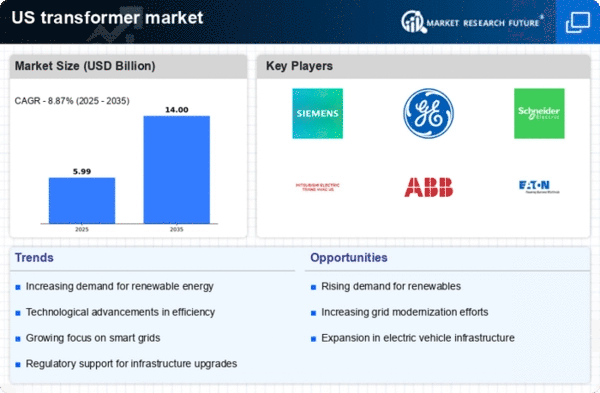

Market Size & Forecast

| 2024 Market Size | 10491.58 (USD Billion) |

| 2035 Market Size | 25389.26 (USD Billion) |

| CAGR (2025 - 2035) | 8.5% |

Major Players

WEG, Eaton, Schneider Electric, Siemens AG, Virginia Transformer Corp, GE Vernova, Hitachi Energy Ltd, Hammond Power Solutions, Delta Star, and ELSCO Transformers.