Expansion of Renewable Energy Sources

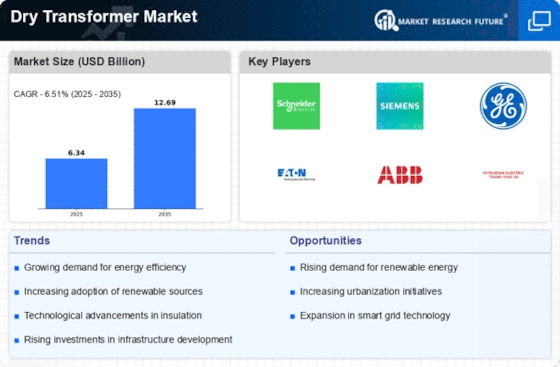

The Dry Transformer Market is poised for growth due to the rapid expansion of renewable energy sources. As countries invest heavily in solar, wind, and hydroelectric power, the need for reliable and efficient power distribution systems becomes paramount. Dry transformers play a crucial role in integrating these renewable energy sources into existing grids, ensuring stable and efficient energy transfer. Recent statistics indicate that renewable energy capacity has increased significantly, with solar and wind accounting for a substantial share of new installations. This shift towards renewables necessitates the deployment of dry transformers, which are well-suited for the variable nature of renewable energy generation, thereby propelling the market forward.

Increasing Demand for Energy Efficiency

The Dry Transformer Market is experiencing a notable surge in demand for energy-efficient solutions. As industries and utilities strive to reduce operational costs and enhance sustainability, dry transformers, known for their lower energy losses, are becoming increasingly favored. According to recent data, energy-efficient transformers can reduce energy losses by up to 30%, making them a compelling choice for energy-conscious organizations. This trend is further supported by regulatory frameworks that incentivize the adoption of energy-efficient technologies. Consequently, the growing emphasis on energy efficiency is likely to drive the expansion of the dry transformer market, as businesses seek to align with environmental standards while optimizing their energy consumption.

Urbanization and Infrastructure Development

The Dry Transformer Market is significantly influenced by the trends of urbanization and infrastructure development. As urban areas expand, the demand for reliable power distribution systems increases. Dry transformers are particularly well-suited for urban environments due to their compact size and reduced environmental impact. Recent data suggests that urban populations are projected to grow substantially, leading to increased energy demands. This urbanization trend necessitates the installation of efficient power distribution systems, including dry transformers, to support the growing infrastructure. Consequently, the ongoing urban development initiatives are expected to drive the demand for dry transformers in various sectors, including residential, commercial, and industrial.

Regulatory Support for Environmental Standards

The Dry Transformer Market is experiencing a favorable regulatory environment that supports the adoption of environmentally friendly technologies. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting energy efficiency. These regulations often include incentives for the use of dry transformers, which are recognized for their lower environmental impact compared to traditional oil-filled transformers. As a result, manufacturers and end-users are increasingly inclined to invest in dry transformer solutions to comply with these regulations. The alignment of market dynamics with regulatory frameworks is likely to bolster the growth of the dry transformer market, as stakeholders seek to meet both compliance requirements and sustainability goals.

Technological Innovations in Transformer Design

The Dry Transformer Market is benefiting from ongoing technological innovations that enhance the performance and reliability of dry transformers. Advances in materials science and engineering have led to the development of transformers that are not only more efficient but also more durable and compact. For instance, the introduction of advanced insulation materials has improved thermal performance, allowing for higher load capacities. Furthermore, smart transformer technologies are emerging, enabling real-time monitoring and diagnostics. These innovations are likely to attract investments and drive market growth, as utilities and industries seek to modernize their infrastructure and improve operational efficiency.