Growing Focus on Drug Development

The tissue microarray market is also being propelled by a growing focus on drug development processes. Pharmaceutical companies are increasingly utilizing tissue microarrays to evaluate drug efficacy and safety during preclinical trials. This method allows for the assessment of drug responses across various tissue types, providing critical insights into therapeutic outcomes. The pharmaceutical sector is projected to invest over $100 billion annually in research and development, with a significant portion directed towards innovative technologies like tissue microarrays. This trend suggests a promising future for the tissue microarray market as it becomes integral to the drug development pipeline.

Rising Demand for Cancer Research

The tissue microarray market is experiencing a notable surge in demand driven by the increasing focus on cancer research. As cancer remains a leading cause of mortality in the US, researchers are seeking efficient methods to analyze tumor samples. Tissue microarrays facilitate high-throughput analysis, allowing for the simultaneous examination of multiple tissue samples. This capability is particularly valuable in identifying biomarkers and understanding tumor heterogeneity. According to recent estimates, the cancer research segment accounts for approximately 40% of the overall tissue microarray market. The growing number of cancer cases and the need for innovative diagnostic tools are likely to propel this market further.

Advancements in Diagnostic Techniques

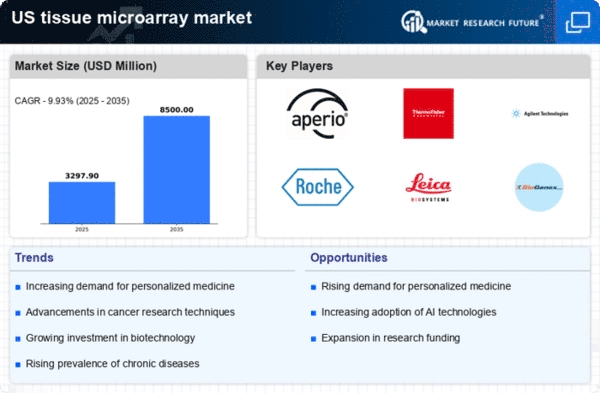

Innovations in diagnostic techniques are significantly influencing the tissue microarray market. The integration of advanced imaging technologies and molecular profiling is enhancing the accuracy and efficiency of tissue analysis. These advancements enable pathologists to obtain more precise information from tissue samples, which is crucial for accurate diagnosis and treatment planning. The market for diagnostic tools is projected to grow at a CAGR of around 8% over the next few years, indicating a robust demand for tissue microarrays as essential components in these diagnostic workflows. As healthcare providers increasingly adopt these technologies, the tissue microarray market is poised for substantial growth.

Emergence of Personalized Therapeutics

The emergence of personalized therapeutics is reshaping the landscape of the tissue microarray market. As healthcare shifts towards tailored treatment approaches, the need for precise biomarker identification becomes paramount. Tissue microarrays play a crucial role in this process by enabling the analysis of multiple biomarkers simultaneously, thus facilitating the development of personalized treatment plans. The market for personalized medicine is expected to reach $2 trillion by 2025, indicating a substantial opportunity for tissue microarrays to support this trend. As clinicians increasingly adopt personalized approaches, the tissue microarray market is likely to experience significant growth.

Increased Funding for Biomedical Research

The tissue microarray market is benefiting from increased funding for biomedical research initiatives. Government and private organizations are allocating substantial resources to support research aimed at understanding complex diseases, including cancer and genetic disorders. This influx of funding is likely to enhance the development and application of tissue microarrays in various research settings. In the US, federal funding for biomedical research has seen a rise of approximately 10% annually, which directly impacts the tissue microarray market. As researchers gain access to better resources, the demand for innovative tools like tissue microarrays is expected to grow, further driving market expansion.