Supportive Regulatory Framework

A supportive regulatory framework is fostering growth in the tissue microarray market. The UK regulatory bodies are increasingly recognizing the importance of innovative diagnostic tools in improving patient care. Streamlined approval processes for new technologies are encouraging companies to invest in the development of advanced tissue microarray systems. This regulatory support is crucial for ensuring that new products meet safety and efficacy standards while expediting their entry into the market. As a result, the tissue microarray market is likely to experience a boost, with an anticipated growth rate of around 5% over the next few years. This environment is conducive to innovation and may lead to the introduction of novel applications for tissue microarrays in clinical diagnostics.

Increased Investment in Cancer Research

The tissue microarray market is experiencing growth due to heightened investment in cancer research. The UK government and private sectors are allocating substantial funds to cancer studies, recognizing the need for innovative diagnostic and therapeutic approaches. Tissue microarrays play a crucial role in these research initiatives by allowing for high-throughput analysis of tumor samples. This technology aids in understanding cancer heterogeneity and treatment responses, which is essential for developing effective therapies. In 2025, the UK is expected to invest over £1 billion in cancer research, further propelling the tissue microarray market. This influx of funding is likely to foster advancements in technology and expand the application of tissue microarrays in clinical settings.

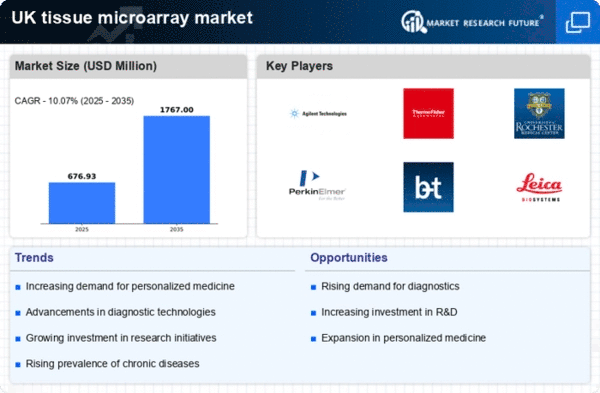

Rising Demand for Personalized Medicine

The increasing focus on personalized medicine is driving the tissue microarray market. As healthcare shifts towards tailored treatments, the need for precise diagnostic tools becomes paramount. Tissue microarrays facilitate the analysis of multiple tissue samples simultaneously, enabling researchers to identify biomarkers associated with specific diseases. This capability is particularly relevant in oncology, where the demand for targeted therapies is surging. In the UK, the tissue microarray market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the growing emphasis on personalized healthcare solutions. The integration of tissue microarrays into clinical practice is likely to enhance patient outcomes and streamline the drug development process.

Growing Awareness of Early Disease Detection

The tissue microarray market is benefiting from the increasing awareness surrounding early disease detection. As healthcare providers and patients recognize the importance of early diagnosis in improving treatment outcomes, the demand for advanced diagnostic tools is rising. Tissue microarrays enable the simultaneous examination of numerous tissue samples, which can lead to the early identification of diseases such as cancer. In the UK, public health campaigns are emphasizing the significance of early detection, which is likely to boost the adoption of tissue microarrays in both research and clinical laboratories. This trend may contribute to a projected market growth of around 7% in the coming years, as healthcare systems seek to implement more effective diagnostic strategies.

Technological Innovations in Diagnostic Tools

Technological innovations are significantly impacting the tissue microarray market. Advances in imaging techniques, data analysis, and automation are enhancing the capabilities of tissue microarrays, making them more efficient and user-friendly. The integration of artificial intelligence and machine learning into tissue microarray analysis is expected to improve accuracy and speed in diagnosing diseases. In the UK, the adoption of these technologies is likely to increase, as laboratories seek to enhance their diagnostic capabilities. The tissue microarray market could see a growth rate of approximately 6% as these innovations become more prevalent, allowing for more comprehensive and precise analyses of tissue samples.