Growing Geriatric Population

The aging population in the US is a significant factor driving the therapeutic medical-guide-wire market. As individuals age, they are more susceptible to various health issues that often require surgical interventions. The US Census Bureau projects that by 2030, all baby boomers will be over 65 years old, leading to a substantial increase in the demand for medical procedures. This demographic shift suggests a corresponding rise in the need for therapeutic medical-guide wires, as older patients frequently undergo minimally invasive surgeries. The therapeutic medical-guide-wire market is poised for growth as healthcare providers adapt to the needs of an aging population, ensuring that they have access to the necessary tools for effective treatment.

Rising Healthcare Expenditure

Increased healthcare spending in the US is another critical driver of the therapeutic medical-guide-wire market. As healthcare budgets expand, hospitals and clinics are more likely to invest in advanced medical technologies, including therapeutic medical-guide wires. According to the Centers for Medicare & Medicaid Services, national health expenditure is projected to grow at an average rate of 5.4% annually, reaching nearly $6 trillion by 2027. This financial commitment to healthcare improvement suggests a robust market for therapeutic medical-guide wires, as providers seek to enhance patient care through innovative solutions. The therapeutic medical-guide-wire market stands to benefit from this trend, as healthcare facilities prioritize investments in high-quality medical devices.

Increased Focus on Patient Safety

The emphasis on patient safety and quality of care is driving changes in the therapeutic medical-guide-wire market. Healthcare providers are increasingly adopting devices that minimize risks and enhance procedural outcomes. Regulatory bodies are also promoting the use of safer medical devices, which influences purchasing decisions. The therapeutic medical-guide-wire market is likely to see growth as manufacturers respond to these demands by developing guide wires that prioritize safety features, such as improved visibility and reduced trauma during insertion. This focus on patient safety aligns with broader healthcare trends aimed at improving overall patient experiences and outcomes, further propelling the market forward.

Advancements in Medical Technology

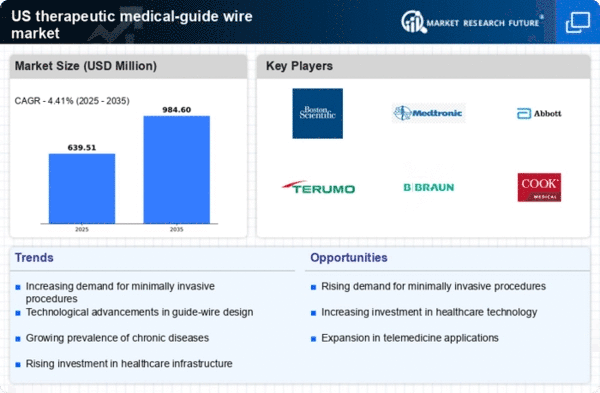

Technological innovations in the medical field are significantly influencing the therapeutic medical-guide-wire market. The introduction of advanced materials and designs, such as hydrophilic coatings and nitinol wires, enhances the performance and safety of guide wires. These advancements allow for better maneuverability and reduced risk of complications during procedures. The market is projected to grow as manufacturers invest in research and development to create more sophisticated guide wires. In 2025, the therapeutic medical-guide-wire market is expected to reach a valuation of approximately $1.5 billion, driven by these technological improvements. As healthcare providers seek to adopt the latest technologies, the demand for high-quality therapeutic medical-guide wires will likely increase.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cardiovascular disorders, diabetes, and cancer in the US is a primary driver for the therapeutic medical-guide-wire market. As these conditions necessitate various interventional procedures, the demand for guide wires is expected to surge. According to recent data, chronic diseases account for approximately 70% of all deaths in the US, highlighting the urgent need for effective treatment options. This trend indicates a growing market for therapeutic medical-guide wires, as healthcare providers increasingly rely on these devices to facilitate complex procedures. The therapeutic medical-guide-wire market is likely to expand as healthcare systems adapt to the increasing burden of chronic diseases. This adaptation will lead to more procedures that utilize guide wires for enhanced patient outcomes.