Growing Defense Budgets

The increasing defense budgets in the US are a primary driver for the surveillance radar market. As national security concerns escalate, the government allocates more funds to enhance military capabilities. In 2025, the US defense budget is projected to exceed $800 billion, with a significant portion directed towards advanced surveillance technologies. This trend indicates a robust demand for sophisticated radar systems that can provide real-time intelligence and situational awareness. The surveillance radar market is likely to benefit from these investments, as military branches seek to upgrade existing systems and develop new capabilities to counter emerging threats. Furthermore, the emphasis on modernization programs suggests a sustained growth trajectory for the market, as defense contractors compete to deliver cutting-edge solutions.

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation into surveillance radar systems is transforming the market landscape. The surveillance radar market is witnessing a shift towards smart radar solutions that leverage AI for enhanced data processing and analysis. These systems can autonomously identify and classify targets, significantly improving operational efficiency. In 2025, the market for AI-driven radar technologies is anticipated to reach $2 billion, driven by the demand for real-time decision-making capabilities. This trend suggests that as military and civilian applications increasingly adopt AI, the surveillance radar market will expand, offering innovative solutions that enhance situational awareness and response times. The potential for automation in radar operations may also lead to cost savings and improved resource allocation.

Regulatory Support and Standardization

Regulatory support and standardization initiatives are playing a crucial role in shaping the surveillance radar market. The US government is actively promoting the adoption of standardized radar systems to ensure interoperability among various agencies and sectors. This regulatory framework is expected to facilitate the growth of the surveillance radar market by providing clear guidelines for technology development and deployment. In 2025, the market is likely to benefit from increased collaboration between public and private sectors, as stakeholders work together to meet regulatory requirements. The emphasis on standardization may also lead to enhanced competition, driving innovation and reducing costs. As the market evolves, regulatory support will be essential in fostering a conducive environment for the development of advanced surveillance radar technologies.

Emerging Threats and Geopolitical Tensions

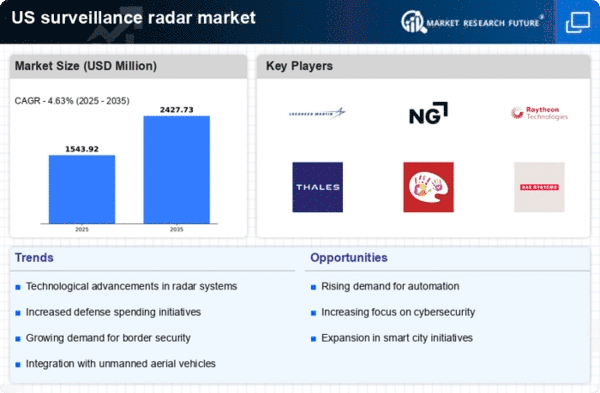

The rise of emerging threats and geopolitical tensions is a critical factor influencing the surveillance radar market. As nations face new security challenges, the need for advanced surveillance systems becomes paramount. The US, in particular, is focusing on countering threats from state and non-state actors, which drives demand for enhanced radar capabilities. The surveillance radar market is responding to this need by developing systems that can detect and track a wide range of aerial and maritime threats. In 2025, the market is expected to grow at a CAGR of approximately 5%, reflecting the urgency for nations to bolster their defense mechanisms. This growth is indicative of a broader trend where countries prioritize investments in surveillance technologies to maintain strategic advantages.

Civilian Applications and Urban Surveillance

The expansion of civilian applications for surveillance radar systems is emerging as a vital driver for the market. Urban areas are increasingly adopting radar technologies for traffic management, public safety, and environmental monitoring. The surveillance radar market is adapting to these needs by developing systems that can operate effectively in complex urban environments. In 2025, the market for civilian radar applications is projected to grow by 6%, reflecting the rising demand for integrated surveillance solutions. This growth is indicative of a broader trend where municipalities seek to enhance security and efficiency through advanced radar technologies. As cities invest in smart infrastructure, the surveillance radar market is likely to see increased opportunities for innovation and collaboration with technology providers.