Rising Data Volume

The exponential growth of data generated by businesses and consumers is a primary driver for the storage in big data market. In the US, data creation is projected to reach 175 zettabytes by 2025, necessitating robust storage solutions. This surge in data volume is attributed to the increasing use of IoT devices, social media, and digital transactions. As organizations seek to harness insights from this vast amount of data, the demand for scalable storage solutions intensifies. Companies are investing in advanced storage technologies to manage and analyze data efficiently, which is likely to propel the storage in-big-data market forward. Furthermore, the need for real-time data processing and analytics is pushing businesses to adopt innovative storage solutions that can accommodate large datasets while ensuring quick access and retrieval.

Increased Cloud Migration

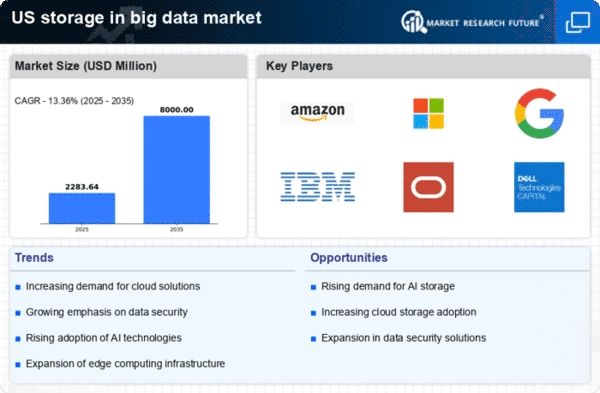

The shift towards cloud computing is a pivotal driver for the storage in big data market. Many organizations in the US are migrating their data storage to cloud-based solutions to enhance scalability, flexibility, and cost-effectiveness. The cloud storage market is projected to grow by over 20% annually, reflecting the increasing preference for cloud solutions among businesses. This migration allows organizations to store vast amounts of data without the need for extensive on-premises infrastructure. As companies seek to leverage the benefits of cloud technology, the demand for integrated storage solutions that can seamlessly connect on-premises and cloud environments is likely to rise. Consequently, the storage in-big-data market is poised for growth as businesses adopt hybrid storage models that combine the advantages of both cloud and traditional storage systems.

Emergence of Advanced Analytics

The growing emphasis on data-driven decision-making is significantly influencing the storage in big data market. Organizations are increasingly leveraging advanced analytics to gain insights from their data, which requires sophisticated storage solutions. In the US, the analytics market is expected to grow at a CAGR of 25% through 2025, driving the need for efficient data storage systems. As businesses adopt predictive analytics, machine learning, and AI, the volume of data processed and stored increases. This trend necessitates the implementation of high-capacity storage solutions that can handle complex data types and large datasets. Consequently, the storage in-big-data market is likely to experience substantial growth as companies invest in technologies that support advanced analytics capabilities, ensuring they remain competitive in their respective industries.

Regulatory Compliance Requirements

The increasing complexity of regulatory compliance is a significant driver for the storage in big data market. In the US, organizations must adhere to various regulations such as GDPR and HIPAA, which mandate stringent data storage and management practices. Compliance with these regulations often requires businesses to implement robust storage solutions that ensure data integrity, security, and accessibility. As companies face potential penalties for non-compliance, the demand for compliant storage systems is likely to rise. This trend is further amplified by the growing awareness of data privacy among consumers, prompting organizations to prioritize secure storage solutions. The storage in-big-data market is expected to benefit from this heightened focus on compliance, as businesses seek to invest in technologies that facilitate adherence to regulatory requirements while optimizing their data management processes.

Technological Advancements in Storage Solutions

Rapid technological advancements in storage solutions are driving the evolution of the storage in big data market. Innovations such as NVMe (Non-Volatile Memory Express), SSDs (Solid State Drives), and advanced data compression techniques are enhancing storage performance and efficiency. In the US, the adoption of SSDs is expected to increase significantly, with market growth projected at 15% annually. These advancements enable organizations to store and access large datasets more quickly, facilitating real-time analytics and decision-making. As businesses increasingly rely on data for strategic initiatives, the demand for high-performance storage solutions is likely to grow. This trend suggests that the storage in-big-data market will continue to expand as companies invest in cutting-edge technologies that improve data storage capabilities and overall operational efficiency.