Rising Data Generation

The exponential increase in data generation across various sectors in North America is a primary driver for the storage in-big-data market. With the proliferation of IoT devices, social media, and digital transactions, it is estimated that data creation will reach 175 zettabytes by 2025. This surge necessitates robust storage solutions to manage, analyze, and derive insights from vast datasets. Organizations are compelled to invest in scalable storage infrastructures to accommodate this growth, leading to a projected market value of $50 billion by 2026. The storage in-big-data market is thus experiencing heightened demand as businesses seek to harness the potential of big data for strategic decision-making.

Expansion of Cloud-Based Solutions

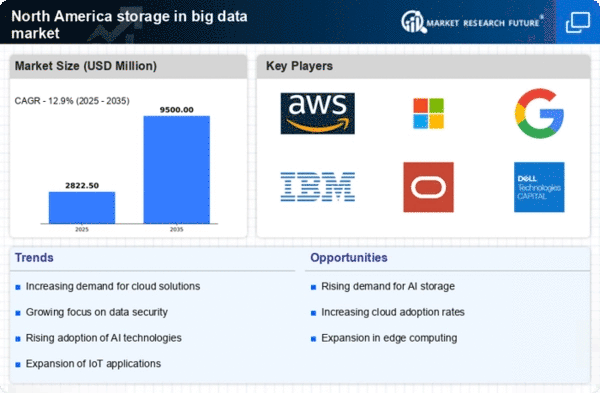

The shift towards cloud-based storage solutions is a significant driver of the storage in-big-data market. Organizations in North America are increasingly adopting cloud technologies to enhance flexibility, scalability, and cost-effectiveness in data management. This transition is expected to contribute to a market growth rate of 30% over the next few years, as businesses seek to optimize their storage capabilities without the burden of maintaining physical infrastructure. The storage in-big-data market is thus witnessing a transformation, with cloud solutions becoming integral to modern data strategies, enabling organizations to store and analyze vast amounts of data efficiently.

Regulatory Compliance Requirements

In North America, stringent regulatory frameworks such as GDPR and HIPAA are driving organizations to enhance their data storage capabilities. Compliance with these regulations mandates secure and efficient data management practices, which in turn fuels the storage in-big-data market. Companies are increasingly investing in advanced storage solutions to ensure data integrity and security, thereby avoiding hefty fines and reputational damage. The market is projected to grow at a CAGR of 20% over the next five years, as organizations prioritize compliance-driven storage strategies. This trend underscores the critical role of the storage in-big-data market in facilitating adherence to legal requirements while optimizing data accessibility.

Advancements in Storage Technologies

Technological innovations in storage solutions, such as NVMe and SSDs, are significantly impacting the storage in-big-data market. These advancements offer faster data retrieval and improved performance, which are essential for processing large volumes of data efficiently. As organizations in North America increasingly adopt these technologies, the demand for high-performance storage systems is expected to rise. The market is anticipated to reach $60 billion by 2027, driven by the need for speed and efficiency in data handling. Consequently, the storage in-big-data market is evolving rapidly, with companies seeking to leverage cutting-edge technologies to enhance their data management capabilities.

Growing Demand for Real-Time Analytics

The increasing need for real-time data analytics is propelling the storage in-big-data market forward. Businesses across various sectors are recognizing the value of timely insights for competitive advantage, leading to a surge in demand for storage solutions that support real-time processing. This trend is particularly evident in industries such as finance and healthcare, where immediate data access can influence critical decisions. The market is projected to grow by 25% annually as organizations invest in storage infrastructures that facilitate real-time analytics. Thus, the storage in-big-data market is becoming increasingly vital for organizations aiming to leverage data-driven strategies effectively.