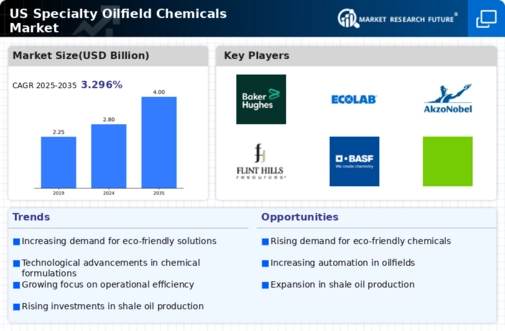

The specialty oilfield-chemicals market is characterized by a dynamic competitive landscape, driven by the increasing demand for enhanced oil recovery and the need for environmentally sustainable solutions. Key players such as Baker Hughes (US), Halliburton (US), and Schlumberger (US) are at the forefront, leveraging their extensive technological capabilities and global reach. Baker Hughes (US) focuses on innovation in digital solutions, while Halliburton (US) emphasizes operational efficiency through strategic partnerships. Schlumberger (US) appears to be investing heavily in sustainable practices, which collectively shapes a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to reduce costs and optimize supply chains, which is crucial in a moderately fragmented market. The competitive structure is influenced by the collective actions of these key players, who are not only competing on product offerings but also on service delivery and technological integration. This strategic positioning allows them to respond effectively to market demands and regulatory changes, thereby enhancing their competitive edge.

In October Baker Hughes (US) announced a partnership with a leading technology firm to develop AI-driven solutions for predictive maintenance in oilfield operations. This strategic move is likely to enhance operational efficiency and reduce downtime, positioning Baker Hughes (US) as a leader in integrating advanced technologies into traditional oilfield practices. The emphasis on AI reflects a broader trend towards digital transformation in the industry.

In September Halliburton (US) launched a new line of eco-friendly drilling fluids aimed at reducing environmental impact. This initiative not only aligns with global sustainability goals but also caters to the increasing regulatory pressures faced by oilfield operators. By prioritizing environmentally friendly solutions, Halliburton (US) is likely to strengthen its market position and appeal to a more environmentally conscious clientele.

In August Schlumberger (US) expanded its operations in the Permian Basin by acquiring a local chemical supplier. This acquisition is expected to enhance Schlumberger's (US) supply chain capabilities and improve its service offerings in a key production area. The strategic importance of this move lies in its potential to streamline operations and reduce costs, thereby increasing competitiveness in a highly sought-after region.

As of November the competitive trends in the specialty oilfield-chemicals market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies seek to enhance their technological capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends.