Increasing Demand for Enhanced Oil Recovery

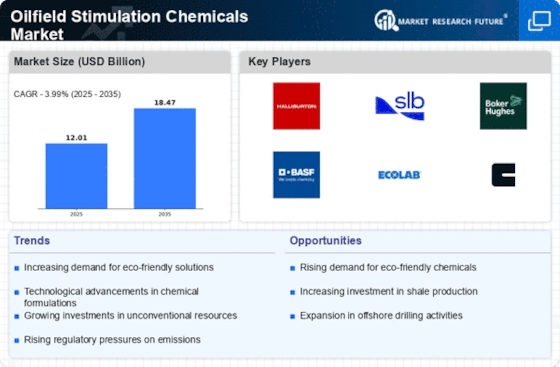

The Oilfield Stimulation Chemicals Market is experiencing a surge in demand for enhanced oil recovery (EOR) techniques. As conventional oil reserves deplete, operators are increasingly turning to EOR methods to maximize extraction from existing fields. This trend is driven by the need to maintain production levels and optimize resource utilization. According to recent estimates, EOR techniques could account for a significant portion of the total oil production in the coming years. The use of specialized stimulation chemicals plays a crucial role in improving the efficiency of these processes, thereby propelling the growth of the Oilfield Stimulation Chemicals Market. Furthermore, advancements in chemical formulations are enhancing the effectiveness of EOR, making it a focal point for investment and research in the industry.

Regulatory Support for Oilfield Development

The Oilfield Stimulation Chemicals Market benefits from favorable regulatory frameworks that support oilfield development. Governments are increasingly recognizing the economic benefits of oil production and are implementing policies that encourage exploration and production activities. This regulatory support often includes incentives for the use of advanced technologies and environmentally friendly practices, which in turn drives the demand for stimulation chemicals. As regulations evolve to promote sustainable practices, the Oilfield Stimulation Chemicals Market is likely to see a shift towards more innovative and efficient chemical solutions. The alignment of regulatory frameworks with industry needs creates a conducive environment for growth and investment in the sector.

Growing Focus on Environmental Sustainability

The Oilfield Stimulation Chemicals Market is increasingly shaped by a growing focus on environmental sustainability. As stakeholders become more aware of the environmental impacts of oilfield operations, there is a push for the development and use of eco-friendly stimulation chemicals. This trend is prompting manufacturers to innovate and create formulations that minimize ecological footprints while maintaining performance. The demand for sustainable practices is not only driven by regulatory pressures but also by consumer preferences for environmentally responsible products. Consequently, the Oilfield Stimulation Chemicals Market is likely to see a shift towards greener alternatives, which could redefine the competitive landscape and open new avenues for growth.

Technological Innovations in Stimulation Techniques

The Oilfield Stimulation Chemicals Market is significantly influenced by ongoing technological innovations in stimulation techniques. Advances in chemical formulations, application methods, and monitoring technologies are enhancing the effectiveness of stimulation processes. These innovations not only improve recovery rates but also reduce environmental impacts, aligning with the industry's shift towards sustainability. The introduction of smart technologies, such as real-time monitoring and data analytics, is enabling operators to optimize their stimulation strategies. As these technologies become more prevalent, the Oilfield Stimulation Chemicals Market is expected to expand, driven by the need for more efficient and effective solutions in oilfield operations.

Rising Exploration Activities in Unconventional Resources

The Oilfield Stimulation Chemicals Market is witnessing a notable increase in exploration activities targeting unconventional resources such as shale gas and tight oil. These resources require advanced stimulation techniques to unlock their potential, leading to a heightened demand for specialized chemicals. The shift towards unconventional resources is driven by the need for energy security and the desire to reduce dependence on traditional oil sources. As operators invest in new technologies and methodologies, the Oilfield Stimulation Chemicals Market is poised for growth. Recent data indicates that the contribution of unconventional resources to total oil production is expected to rise significantly, further emphasizing the importance of stimulation chemicals in these operations.