Health Monitoring Demand

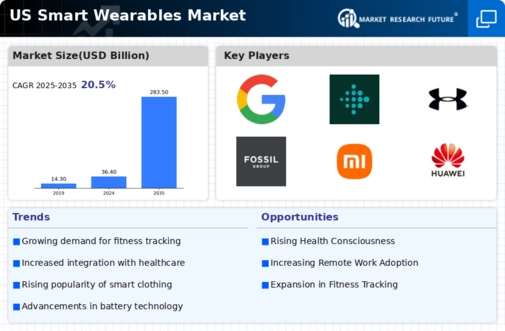

The increasing emphasis on health monitoring is a pivotal driver for the US Smart Wearables Market. Consumers are increasingly seeking devices that can track vital health metrics such as heart rate, blood pressure, and sleep patterns. According to recent data, the market for health-focused wearables is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This surge is largely attributed to a growing awareness of personal health and wellness, as well as the rising prevalence of chronic diseases. As a result, manufacturers are innovating to create more sophisticated devices that not only monitor health but also provide actionable insights, thereby enhancing user engagement and satisfaction.

Rising Consumer Awareness

Rising consumer awareness regarding the benefits of smart wearables is a significant driver for the US Smart Wearables Market. As individuals become more informed about the advantages of using wearables for health tracking and fitness monitoring, demand is expected to increase. Surveys indicate that a substantial percentage of consumers are now aware of the capabilities of smart wearables, including their potential to improve health outcomes and enhance lifestyle choices. This heightened awareness is further fueled by marketing campaigns and endorsements from health professionals, which are likely to encourage more consumers to invest in these devices. Consequently, this trend is anticipated to contribute to the overall growth of the market.

Technological Advancements

Technological advancements play a crucial role in propelling the US Smart Wearables Market forward. Innovations in sensor technology, battery life, and connectivity options have led to the development of more efficient and user-friendly devices. For instance, the integration of artificial intelligence and machine learning algorithms into wearables allows for more accurate health assessments and personalized recommendations. Furthermore, the introduction of 5G technology is expected to enhance the functionality of smart wearables, enabling real-time data transmission and improved user experiences. As these technologies continue to evolve, they are likely to attract a broader consumer base, thereby driving market growth.

Focus on Fitness and Lifestyle

The growing focus on fitness and lifestyle enhancement is a prominent driver for the US Smart Wearables Market. As more individuals prioritize health and fitness, the demand for wearables that support active lifestyles is on the rise. Devices such as fitness trackers and smartwatches are increasingly being utilized to monitor physical activity, set fitness goals, and track progress. Market data indicates that the fitness segment of the wearables market is expected to account for a substantial share, driven by the popularity of fitness-related applications and social sharing features. This trend suggests that consumers are not only interested in health monitoring but also in engaging with their fitness communities, further propelling market growth.

Integration with Mobile Devices

The seamless integration of smart wearables with mobile devices is another key driver for the US Smart Wearables Market. As smartphones become ubiquitous, consumers are increasingly looking for wearables that can easily connect and synchronize with their mobile devices. This integration allows users to receive notifications, track fitness goals, and access health data conveniently. Data suggests that a significant portion of wearable users also own smartphones, indicating a strong correlation between the two markets. Manufacturers are responding to this trend by developing wearables that offer enhanced compatibility with various mobile operating systems, thereby expanding their market reach and appealing to tech-savvy consumers.