Top Industry Leaders in the US Smart Wearables Market

The Competitive Landscape of the US Smart Wearables Market

In the pulsating rhythm of the US smart wearables market, where technology dances on wrists and monitors health metrics, a fierce competition plays out. This industry hums with innovation, diverse players, and the promise of transforming personal wellness and consumer electronics. Navigating this vibrant space requires discerning the strategies of key players, understanding market share nuances, and recognizing the emerging trends shaping its future.

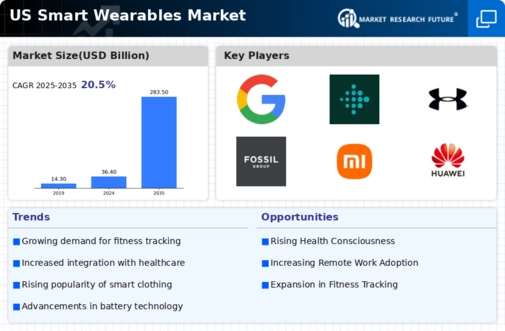

Key Players:

- Google LLC

- Sony Corporation

- Garmin Ltd

- Samsung Electronics Co. Ltd.

- Amazon

- Fitbit

- Under Armour

- Fossil Group

- Solos Technology Limited

- Xiaomi

- Huawei

- Bose

- Nuheara

- Starkey

Strategies Adopted by Leaders:

- Technology Prowess: Apple and Samsung lead the charge with expertise in advanced health sensors, intuitive operating systems, and seamless integration with their respective hardware ecosystems, catering to tech-savvy and brand-loyal consumers.

- Vertical Specialization: Fitbit focuses on affordable and user-friendly fitness trackers for health enthusiasts, while Garmin targets ruggedized smartwatches for athletes and outdoor adventurers.

- Partnership Play: Fossil collaborates with fashion brands and health organizations, offering stylish wearables with diverse functionalities and specialized health monitoring features.

- Open-Source Initiatives and App Development: Platforms like Google Wear OS and Samsung Tizen encourage third-party app development, expanding functionality and attracting a wider user base.

- Focus on Privacy and Security: Prioritizing robust data encryption, transparent data practices, and compliance with privacy regulations builds trust and enhances user confidence.

Factors for Market Share Analysis:

- Functionality and Feature Set: Companies offering wearables with comprehensive health monitoring, advanced fitness tracking, seamless smartphone integration, and unique functionalities command premium prices and secure market share by catering to diverse user needs.

- User Interface and Design: Providing intuitive screens, user-friendly interfaces, and attractive designs attracts a wider customer base and enhances user experience.

- Battery Life and Performance: Offering wearables with longer battery life and high-performance processors minimizes charging disruptions and ensures smooth operation, enhancing user satisfaction.

- Cost Competitiveness and Affordability: Balancing advanced features with an attractive price point is crucial for capturing market share, particularly in price-sensitive segments and demographics.

- Focus on Wearable Applications and Ecosystem Integration: Developing seamless integration with health platforms, fitness apps, and smart home systems builds user engagement and opens doors to cross-selling opportunities.

New and Emerging Companies:

- Startups like Whoop and Oura Ring: These innovators focus on developing minimalist and data-driven wearables emphasizing sleep tracking, personalized health insights, and advanced performance optimization, catering to wellness and fitness enthusiasts.

- Academia and Research Labs: Stanford University's Wearable Electronics Lab and MIT's Media Lab explore next-generation technologies like biocompatible sensors, flexible electronics, and non-invasive disease monitoring, shaping the future of the market.

- Advanced Material Science Innovations: Companies like 3M and Dow Chemical develop durable and flexible materials for improved comfort, enhanced functionality, and water resistance, enabling the development of more versatile and user-friendly wearables.

Industry Developments:

Maxwell Technologies:

- October 25, 2023: Announced production ramp-up of their Ultracapacitor Energy Storage System (UESS) for commercial EV fleets, offering rapid charging and extended range.

- August 2023: Partnered with a leading bus manufacturer to integrate their UESS technology into new electric buses for improved energy efficiency and performance.

Panasonic Corporation:

- October 20, 2023: Unveiled their latest high-voltage lithium-ion capacitors for 800V+ EV systems, offering fast charging capabilities and compact size.

- July 2023: Announced plans to expand their EV capacitor production capacity in China to meet growing demand.

Vishay Intertechnology, Inc.:

- October 19, 2023: Launched a new series of film capacitors specifically designed for DC link applications in EVs, with high ripple current capability and extended temperature range.

- May 2023: Partnered with a major EV charging infrastructure provider to supply capacitors for their fast charging stations.