Government Initiatives and Funding

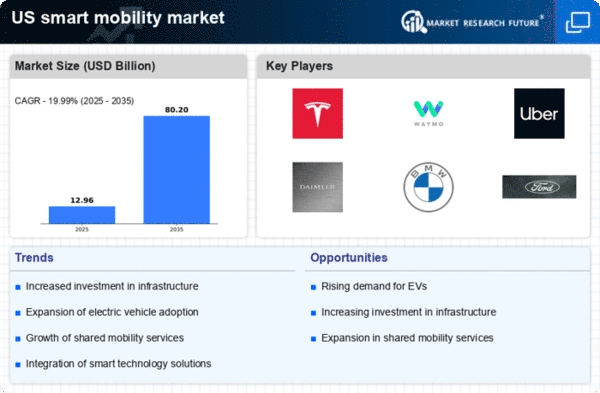

The smart mobility market in the US is experiencing a surge in government initiatives aimed at enhancing transportation infrastructure. Federal and state governments are allocating substantial funding to support projects that promote smart mobility solutions. For instance, the Infrastructure Investment and Jobs Act has earmarked billions of dollars for modernizing transportation systems, which includes investments in smart traffic management and electric vehicle charging stations. This financial backing is likely to accelerate the adoption of innovative mobility solutions, thereby fostering growth in the smart mobility market. Furthermore, local governments are increasingly collaborating with private sector players to implement smart city projects, which could further enhance the efficiency and sustainability of urban transportation.

Urbanization and Population Growth

The ongoing trend of urbanization in the US is significantly impacting the smart mobility market. As more individuals migrate to urban areas, the demand for efficient and sustainable transportation solutions intensifies. According to the US Census Bureau, urban areas are projected to house approximately 90% of the population by 2050. This demographic shift necessitates the development of smart mobility solutions that can alleviate congestion and reduce emissions. Consequently, cities are investing in smart public transportation systems, integrated mobility platforms, and infrastructure that supports electric and shared vehicles. The increasing population density in urban centers is likely to drive innovation and investment in the smart mobility market, as stakeholders seek to address the challenges posed by urban growth.

Environmental Concerns and Sustainability

Growing environmental concerns are increasingly influencing the smart mobility market in the US. As awareness of climate change and air pollution rises, there is a pressing need for sustainable transportation solutions. The smart mobility market is responding to this demand by promoting electric vehicles, shared mobility options, and public transportation systems that reduce carbon footprints. According to the Environmental Protection Agency, transportation accounts for nearly 29% of greenhouse gas emissions in the US, highlighting the urgency for cleaner alternatives. Consequently, stakeholders in the smart mobility market are likely to invest in technologies and infrastructure that support sustainable practices, aligning with broader environmental goals and regulations.

Technological Advancements in Connectivity

Technological advancements in connectivity are playing a pivotal role in shaping the smart mobility market in the US. The proliferation of 5G technology is enhancing communication between vehicles, infrastructure, and users, thereby enabling real-time data exchange. This connectivity facilitates the development of intelligent transportation systems that optimize traffic flow and improve safety. Moreover, the integration of Internet of Things (IoT) devices in vehicles and infrastructure is providing valuable insights into mobility patterns, which can inform urban planning and policy decisions. As these technologies continue to evolve, they are expected to drive the growth of the smart mobility market by enabling more efficient and responsive transportation solutions.

Consumer Demand for Convenience and Efficiency

Consumer preferences are shifting towards convenience and efficiency, which is significantly impacting the smart mobility market in the US. As individuals seek seamless and user-friendly transportation options, there is a growing demand for integrated mobility solutions that combine various modes of transport. This trend is evident in the rise of mobile applications that facilitate ride-sharing, public transit access, and real-time information on transportation options. Additionally, consumers are increasingly favoring electric and shared vehicles as they offer cost-effective and environmentally friendly alternatives. The smart mobility market is likely to evolve in response to these changing consumer expectations, leading to the development of innovative solutions that enhance the overall mobility experience.