Regulatory Compliance and Standards

The secondary paper-and-paperboard-luxury-packaging market is influenced by stringent regulatory compliance and standards aimed at ensuring product safety and environmental sustainability. Regulations regarding the use of materials, labeling, and waste management are becoming more rigorous, compelling companies to adapt their packaging strategies accordingly. Compliance with these regulations is essential for market access and brand reputation. As a result, businesses are investing in research and development to create packaging solutions that meet these standards while still appealing to consumers. This focus on compliance not only mitigates risks but also fosters innovation within the secondary paper-and-paperboard-luxury-packaging market, as companies strive to balance regulatory demands with consumer expectations.

Growth of E-Commerce and Online Retail

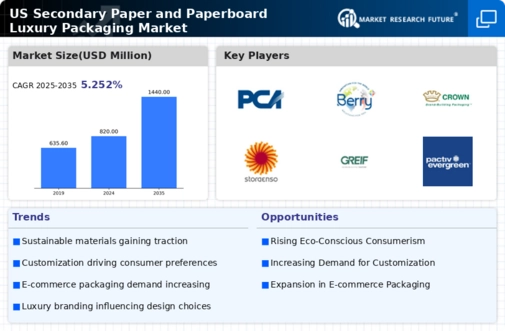

The surge in e-commerce and online retail is significantly impacting the secondary paper-and-paperboard-luxury-packaging market. With online shopping becoming a preferred choice for many consumers, the demand for attractive and protective packaging has escalated. In 2025, e-commerce sales in the US are expected to reach approximately $1 trillion, which translates to a substantial increase in packaging requirements. Luxury brands are particularly focused on creating unboxing experiences that reflect their brand identity, leading to innovative packaging designs. This trend not only enhances customer satisfaction but also drives sales, thereby contributing to the growth of the secondary paper-and-paperboard-luxury-packaging market.

Consumer Preference for Premium Products

There is a discernible shift in consumer preferences towards premium products, which is positively influencing the secondary paper-and-paperboard-luxury-packaging market. As disposable income rises, consumers are increasingly willing to invest in high-quality, luxury items that offer a sense of exclusivity. This trend is evident in sectors such as cosmetics, gourmet foods, and high-end fashion, where packaging plays a crucial role in brand perception. The luxury packaging segment is projected to grow by approximately 6% annually, driven by the need for distinctive and aesthetically pleasing packaging solutions. Brands are leveraging this trend to differentiate themselves in a competitive market, thereby enhancing the overall value of their products.

Rising Demand for Eco-Friendly Packaging

The secondary paper-and-paperboard-luxury-packaging market is seeing an increase in demand for eco-friendly packaging solutions. As consumers become more environmentally conscious, brands are compelled to adopt sustainable practices. This shift is reflected in the market, where eco-friendly packaging options are projected to grow at a CAGR of approximately 8% over the next five years. Companies are increasingly utilizing recycled materials and biodegradable options, which not only appeal to eco-conscious consumers but also align with regulatory pressures for sustainability. The growing emphasis on reducing carbon footprints and waste is likely to drive innovation in the secondary paper-and-paperboard-luxury-packaging market, as businesses seek to enhance their brand image while meeting consumer expectations.

Technological Innovations in Packaging Solutions

Technological advancements are reshaping the secondary paper-and-paperboard-luxury-packaging market, offering new opportunities for efficiency and creativity. Innovations such as digital printing, smart packaging, and automation are enabling brands to create customized packaging solutions that cater to specific consumer needs. For instance, digital printing allows for short runs of unique designs, which can enhance brand storytelling. Moreover, smart packaging technologies, which may include QR codes and NFC tags, are becoming increasingly popular, providing consumers with interactive experiences. These technological innovations not only improve operational efficiency but also enhance the overall consumer experience, thereby driving growth in the secondary paper-and-paperboard-luxury-packaging market.