E-commerce Growth

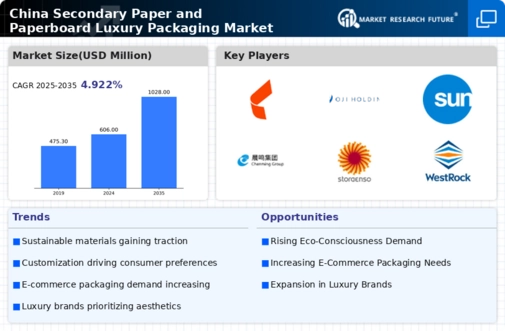

The rapid growth of e-commerce in China is a significant driver for the Secondary Paper And Paperboard Luxury Packaging Market. With the increasing number of online shoppers, luxury brands are adapting their packaging strategies to ensure that products arrive safely and in pristine condition. In 2025, e-commerce sales in China were projected to reach USD 2 trillion, leading to a heightened demand for packaging solutions that cater to the online retail environment. This shift necessitates the use of durable and visually appealing packaging that not only protects the product but also enhances the overall customer experience. As e-commerce continues to expand, the China Secondary Paper And Paperboard Luxury Packaging Market is likely to see a corresponding increase in demand for innovative packaging solutions tailored to online sales.

Luxury Aesthetics

The demand for luxury aesthetics in packaging is a significant driver within the China Secondary Paper And Paperboard Luxury Packaging Market. As disposable income levels rise among Chinese consumers, there is an increasing preference for premium products that offer an elevated unboxing experience. Luxury brands are investing in high-quality packaging that reflects their brand identity and enhances the perceived value of their products. In 2025, the luxury packaging segment in China was estimated to account for over 25% of the total packaging market, underscoring the importance of aesthetics in consumer purchasing decisions. This trend is particularly evident in sectors such as cosmetics, fashion, and gourmet food, where packaging serves as a critical touchpoint for brand engagement. As a result, the emphasis on luxury aesthetics is likely to continue driving innovation and growth in the China Secondary Paper And Paperboard Luxury Packaging Market.

Regulatory Support

Regulatory support from the Chinese government is a key driver influencing the China Secondary Paper And Paperboard Luxury Packaging Market. The government has introduced various policies aimed at promoting sustainable packaging practices and reducing environmental impact. For instance, the implementation of the Extended Producer Responsibility (EPR) policy encourages manufacturers to take responsibility for the entire lifecycle of their packaging. This regulatory framework not only incentivizes the use of recyclable materials but also fosters innovation in packaging design. In 2025, it was estimated that compliance with these regulations would lead to a 20% increase in the use of sustainable packaging materials within the industry. As regulatory support continues to evolve, it is likely to further propel the growth and transformation of the China Secondary Paper And Paperboard Luxury Packaging Market.

Sustainability Focus

The growing emphasis on sustainability within the China Secondary Paper And Paperboard Luxury Packaging Market is a pivotal driver. As consumers increasingly demand eco-friendly packaging solutions, manufacturers are compelled to adopt sustainable practices. The Chinese government has implemented stringent regulations aimed at reducing plastic waste, which has led to a surge in the use of recycled paper and paperboard materials. In 2025, the market for sustainable packaging in China was valued at approximately USD 30 billion, indicating a robust shift towards environmentally responsible packaging options. This trend not only aligns with global sustainability goals but also enhances brand reputation, as companies that prioritize eco-friendly packaging are likely to attract a more conscientious consumer base. Consequently, the focus on sustainability is expected to continue shaping the landscape of the China Secondary Paper And Paperboard Luxury Packaging Market.

Technological Advancements

Technological advancements play a crucial role in the evolution of the China Secondary Paper And Paperboard Luxury Packaging Market. Innovations in printing technology, such as digital printing and advanced finishing techniques, have enabled manufacturers to produce high-quality packaging that meets the aesthetic demands of luxury brands. In 2025, the adoption of digital printing in the packaging sector in China was projected to grow by 15%, reflecting the industry's shift towards more personalized and intricate designs. Furthermore, automation in production processes has improved efficiency and reduced costs, allowing companies to respond swiftly to market trends. These technological developments not only enhance the visual appeal of luxury packaging but also contribute to operational efficiency, thereby driving growth in the China Secondary Paper And Paperboard Luxury Packaging Market.