Rising Incidence of Limb Loss

The increasing incidence of limb loss in the US is a critical driver for the robotics prosthetics market. Factors such as diabetes, vascular diseases, and traumatic injuries contribute to this trend. According to recent data, approximately 2 million individuals in the US are living with limb loss, and this number is projected to rise by 185,000 annually. This growing population of potential users creates a substantial demand for advanced prosthetic solutions. As the need for effective rehabilitation and mobility solutions intensifies, the robotics prosthetics market is likely to expand significantly. The integration of robotics technology into prosthetics offers enhanced functionality and user experience, which may further attract individuals seeking improved quality of life. Thus, the rising incidence of limb loss appears to be a pivotal factor driving market growth.

Supportive Regulatory Environment

The regulatory landscape in the US is becoming increasingly supportive of innovations in the robotics prosthetics market. Regulatory bodies, such as the Food and Drug Administration (FDA), are streamlining the approval processes for new prosthetic technologies, which may facilitate quicker market entry for innovative products. This supportive environment encourages manufacturers to invest in research and development, leading to the introduction of cutting-edge solutions. Additionally, the FDA's focus on promoting safe and effective medical devices aligns with the interests of consumers seeking reliable prosthetic options. As regulations evolve to accommodate advancements in technology, the robotics prosthetics market is likely to benefit from increased product availability and diversity, ultimately enhancing consumer choice and driving market growth.

Increased Awareness and Acceptance

There is a growing awareness and acceptance of robotics prosthetics among both healthcare professionals and potential users in the US. Educational initiatives and outreach programs have played a significant role in informing individuals about the benefits of advanced prosthetic solutions. This heightened awareness is likely to lead to increased adoption rates, as more people recognize the potential of robotics prosthetics to enhance mobility and independence. Furthermore, as success stories of users become more prevalent, societal perceptions are shifting positively towards the use of robotics in rehabilitation. This cultural shift may contribute to a more favorable environment for the robotics prosthetics market, encouraging investment and innovation. The increasing acceptance of these technologies could potentially drive market growth as more individuals seek out advanced solutions for limb loss.

Advancements in Robotics Technology

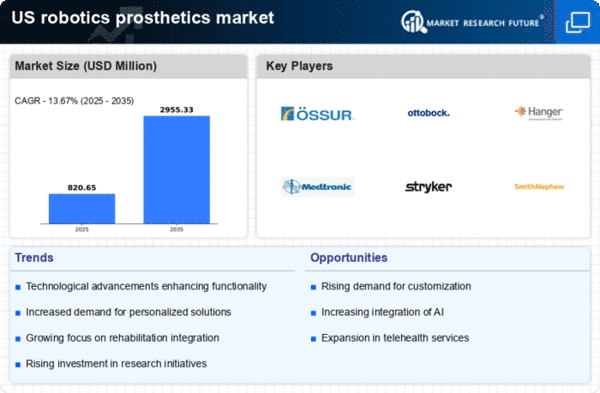

Technological innovations in robotics are transforming the landscape of the robotics prosthetics market. The development of sophisticated sensors, artificial intelligence, and machine learning algorithms has led to the creation of prosthetic devices that can adapt to users' movements and environments. For instance, the introduction of myoelectric prosthetics, which utilize electrical signals from muscles, has revolutionized user control and functionality. The market for robotics prosthetics is projected to reach approximately $3 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. These advancements not only enhance the performance of prosthetic devices but also improve user satisfaction and acceptance. As technology continues to evolve, the robotics prosthetics market is expected to witness further growth driven by these innovations.

Growing Investment in Healthcare Technology

Investment in healthcare technology is on the rise in the US, which is a significant driver for the robotics prosthetics market. Venture capital funding and government grants are increasingly directed towards innovative healthcare solutions, including robotics prosthetics. In 2025, investments in healthcare technology are expected to exceed $100 billion, with a notable portion allocated to prosthetic advancements. This influx of capital enables companies to enhance their research and development efforts, leading to the creation of more effective and user-friendly prosthetic devices. As funding continues to grow, the robotics prosthetics market is likely to experience accelerated innovation and expansion, ultimately benefiting users seeking improved mobility solutions.