Rising Disposable Income

An increase in disposable income across various regions is contributing to the growth of the Global Dental Prosthetics Market Industry. As individuals have more financial resources, they are more inclined to invest in dental care, including prosthetic solutions. This trend is particularly evident in emerging economies, where rising living standards are enabling greater access to dental services. The market's expansion is supported by the fact that patients are increasingly willing to pay for high-quality dental prosthetics, which are perceived as essential for maintaining overall health and well-being. This shift in consumer behavior is likely to bolster market growth in the coming years.

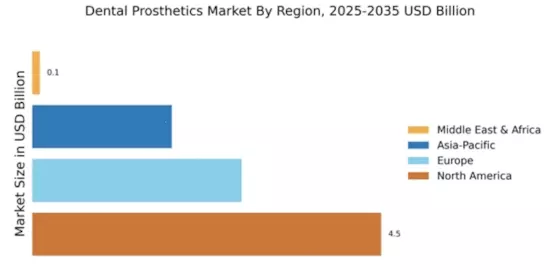

Market Growth Projections

The Global Dental Prosthetics Market Industry is poised for substantial growth, with projections indicating a market value of 9.1 USD Billion in 2024 and an anticipated increase to 16.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.72% from 2025 to 2035. Such figures reflect the increasing demand for dental prosthetics driven by various factors, including technological advancements, rising awareness of oral health, and demographic shifts. The market's expansion is indicative of the broader trends in healthcare, where dental health is increasingly recognized as a vital component of overall well-being.

Technological Advancements

Technological innovations in dental prosthetics are transforming the landscape of the Global Dental Prosthetics Market Industry. Advancements such as 3D printing, CAD/CAM technology, and digital impressions enhance the precision and efficiency of prosthetic fabrication. These technologies not only improve patient outcomes but also reduce the time required for production. As a result, the market is expected to experience a compound annual growth rate of 5.72% from 2025 to 2035. The integration of these technologies allows for customized solutions that cater to individual patient needs, thereby driving demand and expanding the market's reach.

Rising Geriatric Population

The increasing geriatric population globally is a pivotal driver for the Global Dental Prosthetics Market Industry. As individuals age, the likelihood of dental issues such as tooth loss and decay escalates, necessitating prosthetic solutions. By 2024, the market is projected to reach 9.1 USD Billion, reflecting the growing demand for dental prosthetics among older adults. This demographic shift is further compounded by the fact that the World Health Organization indicates that the global population aged 60 years and older is expected to double from 12% to 22% by 2050. Consequently, the need for effective dental prosthetic solutions is likely to surge in the coming years.

Increasing Awareness of Oral Health

Growing awareness regarding oral health and hygiene is significantly influencing the Global Dental Prosthetics Market Industry. Educational campaigns and initiatives by health organizations are emphasizing the importance of maintaining dental health, which in turn drives the demand for prosthetic solutions. As individuals become more conscious of their oral health, they are more likely to seek dental care, including prosthetics. This trend is reflected in the projected market growth, with estimates indicating a rise to 16.8 USD Billion by 2035. Enhanced awareness not only promotes preventive care but also encourages individuals to address existing dental issues through prosthetic interventions.

Growing Incidence of Dental Disorders

The rising prevalence of dental disorders globally is a crucial driver for the Global Dental Prosthetics Market Industry. Conditions such as periodontal disease, tooth decay, and oral cancers are becoming increasingly common, leading to a higher demand for dental prosthetics. The World Health Organization reports that nearly 3.5 billion people are affected by oral diseases, highlighting the urgent need for effective dental solutions. As the market evolves, the demand for prosthetic devices is expected to grow, with projections indicating a market value of 9.1 USD Billion by 2024. This trend underscores the importance of addressing dental health issues through innovative prosthetic solutions.