Increased Funding and Investment

The regenerative medicine market is witnessing a notable increase in funding and investment from both public and private sectors. Government initiatives, such as the National Institutes of Health (NIH) and the Food and Drug Administration (FDA), are allocating substantial resources to support research and development in this field. In 2025, funding for regenerative medicine research is projected to exceed $10 billion, highlighting the commitment to advancing this innovative sector. Additionally, venture capital investments are flowing into startups focused on regenerative therapies, further stimulating market growth. This influx of capital is likely to accelerate the development of new treatments and technologies, positioning the regenerative medicine market as a key player in the future of healthcare.

Growing Prevalence of Chronic Diseases

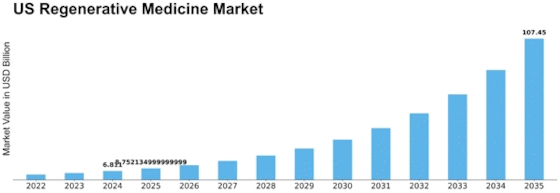

The increasing prevalence of chronic diseases in the US is a critical driver for the regenerative medicine market. Conditions such as diabetes, cardiovascular diseases, and neurodegenerative disorders are on the rise, necessitating innovative treatment solutions. According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for 7 of the 10 leading causes of death in the US. This alarming statistic underscores the urgent need for effective therapies that regenerative medicine can provide. As healthcare providers seek to address these challenges, the market is expected to expand significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. This growth reflects the potential of regenerative therapies to transform patient care and improve quality of life.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the regenerative medicine market. Patients increasingly seek tailored treatment options that cater to their unique genetic and biological profiles. This trend is prompting researchers and clinicians to develop therapies that are not only effective but also customized to individual needs. The market for personalized medicine is expected to grow substantially, with estimates suggesting it could reach $2 trillion by 2030. As regenerative medicine aligns with this demand, it is likely to see enhanced adoption and integration into clinical practice. This alignment may lead to improved patient outcomes and satisfaction, further driving the growth of the regenerative medicine market.

Expanding Applications in Various Medical Fields

The regenerative medicine market is expanding its applications across various medical fields, including orthopedics, cardiology, and dermatology. This diversification is driven by the increasing recognition of regenerative therapies' potential to address a wide range of conditions. For instance, stem cell therapies are being explored for their efficacy in treating orthopedic injuries and degenerative diseases. The market is projected to grow at a CAGR of approximately 25% as more healthcare providers adopt these innovative solutions. Additionally, advancements in tissue engineering and biomaterials are enabling the development of novel treatments that could revolutionize patient care. As these applications continue to evolve, they are likely to contribute significantly to the overall growth of the regenerative medicine market.

Technological Advancements in Regenerative Medicine

The regenerative medicine market is experiencing a surge in technological advancements that enhance treatment efficacy and patient outcomes. Innovations in gene editing, such as CRISPR, and stem cell therapies are at the forefront of this evolution. These technologies enable precise modifications at the cellular level, potentially leading to breakthroughs in treating previously incurable diseases. The market is projected to reach approximately $50 billion by 2026, driven by these advancements. Furthermore, the integration of artificial intelligence in research and clinical applications is streamlining processes, reducing costs, and improving patient care. As these technologies continue to develop, they are likely to attract significant investment, further propelling the regenerative medicine market forward.

Leave a Comment