Rising Focus on Energy Efficiency

The printed electronics market is experiencing a rising focus on energy efficiency, which is influencing product development and consumer preferences. As industries strive to reduce energy consumption and minimize environmental impact, printed electronics offer solutions that align with these goals. For instance, the use of organic photovoltaics in printed electronics can lead to more sustainable energy solutions. The market for energy-efficient electronics is expected to grow significantly, with projections indicating a CAGR of 8% through 2025. This trend suggests that manufacturers in the printed electronics market are likely to prioritize energy-efficient designs, thereby enhancing their competitive edge and meeting the increasing demand for sustainable products.

Expansion of Automotive Applications

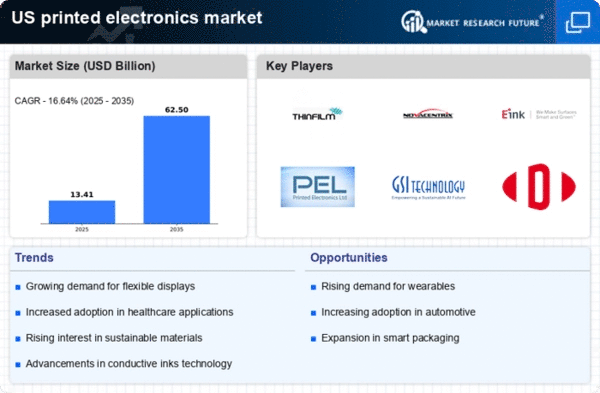

The printed electronics market is poised for growth due to the expansion of automotive applications. As the automotive industry increasingly incorporates electronic components for enhanced functionality, printed electronics are becoming integral to vehicle design. Features such as printed sensors, displays, and lighting systems are gaining traction, contributing to the overall efficiency and performance of vehicles. The automotive sector is projected to invest heavily in electronic systems, with estimates suggesting that the market for automotive electronics could reach $400 billion by 2025. This trend indicates a substantial opportunity for printed electronics, as manufacturers seek to innovate and improve vehicle technology, thereby driving demand in the printed electronics market.

Growing Demand for Wearable Technology

The printed electronics market is significantly influenced by the growing demand for wearable technology. As consumers increasingly seek devices that monitor health and fitness, manufacturers are turning to printed electronics to create lightweight, flexible, and cost-effective solutions. The market for wearables is projected to reach approximately $60 billion by 2025, with printed electronics playing a crucial role in this expansion. These technologies enable the integration of sensors and displays into fabrics, enhancing user experience and functionality. Consequently, the rise in wearable technology is likely to propel the printed electronics market, as companies strive to innovate and meet consumer expectations for advanced features and comfort.

Increased Investment in Smart Packaging

The printed electronics market is benefiting from increased investment in smart packaging solutions. Companies are recognizing the potential of printed electronics to enhance packaging with features such as QR codes, NFC tags, and sensors that provide real-time data. This trend is particularly evident in the food and beverage industry, where smart packaging can improve supply chain transparency and consumer engagement. The market for smart packaging is expected to grow at a CAGR of around 7% through 2025, indicating a robust opportunity for printed electronics. As businesses seek to differentiate their products and improve customer interaction, the demand for printed electronics in packaging applications is likely to rise, further driving growth in the printed electronics market.

Technological Innovations in Printing Techniques

The printed electronics market is experiencing a surge in technological innovations that enhance printing techniques. Advanced methods such as inkjet and screen printing are becoming increasingly sophisticated, allowing for higher resolution and more complex designs. These innovations are not only improving the quality of printed electronics but also reducing production costs. For instance, the adoption of roll-to-roll printing technology has the potential to lower manufacturing expenses by up to 30%. As a result, manufacturers are more inclined to invest in these technologies, which is likely to drive growth in the printed electronics market. Furthermore, the ability to produce flexible and lightweight electronic components is expanding the application range, particularly in sectors like consumer electronics and automotive, thereby stimulating demand in the printed electronics market.