Growing Awareness of Chronic Diseases

The rising awareness of chronic diseases is a significant driver for the predictive disease-analytics market. As the prevalence of conditions such as diabetes and heart disease continues to escalate, there is a pressing need for effective management strategies. Predictive analytics can help identify individuals at risk and facilitate early interventions, potentially reducing the burden on healthcare systems. Recent studies indicate that chronic diseases account for approximately 75% of healthcare spending in the US. This alarming statistic underscores the necessity for predictive disease-analytics solutions, which are likely to gain traction as healthcare providers seek to mitigate the impact of chronic illnesses.

Integration of Big Data in Healthcare

The integration of big data into healthcare systems is transforming the predictive disease-analytics market by enabling the analysis of vast amounts of health-related data. With vast amounts of health-related data generated daily, the ability to analyze and interpret this information is crucial. Big data analytics allows for the identification of trends and patterns that can inform clinical decision-making. The healthcare big data market is projected to reach $68 billion by 2025, highlighting the increasing reliance on data-driven insights. As healthcare organizations adopt big data technologies, the predictive disease-analytics market is likely to experience significant growth, driven by the demand for enhanced analytical capabilities.

Rising Demand for Personalized Medicine

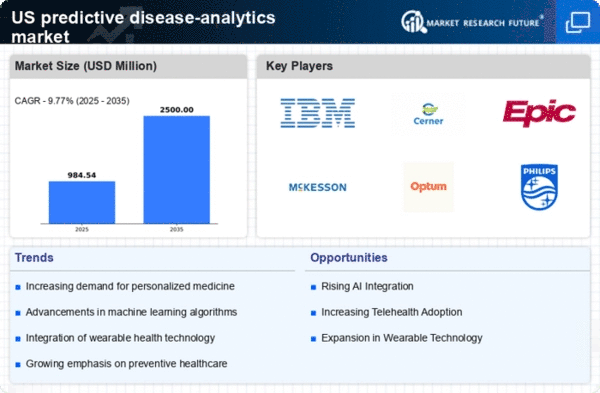

The increasing emphasis on personalized medicine is a pivotal driver for the predictive disease-analytics market. As healthcare shifts towards tailored treatment plans, predictive analytics plays a crucial role in identifying individual patient needs. This trend is evidenced by a projected growth rate of 25% in the personalized medicine sector by 2027. The ability to analyze genetic, environmental, and lifestyle factors allows healthcare providers to predict disease susceptibility and treatment responses more accurately. Consequently, the predictive disease-analytics market is likely to expand as healthcare systems adopt these advanced analytics to enhance patient outcomes and optimize resource allocation.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare significantly drives the predictive disease-analytics market by prioritizing strategies that focus on prevention rather than treatment. As healthcare costs continue to rise, stakeholders are prioritizing strategies that focus on prevention rather than treatment. Predictive analytics enables healthcare providers to identify at-risk populations and implement early intervention strategies. This shift is reflected in a 15% increase in funding for preventive health programs over the past few years. By utilizing predictive analytics, healthcare systems can reduce hospital admissions and improve overall population health, thereby fostering growth in the predictive disease-analytics market.

Advancements in Data Collection Technologies

Technological advancements in data collection are significantly influencing the predictive disease-analytics market. The proliferation of wearable devices and mobile health applications enables continuous monitoring of patient health metrics. This influx of real-time data enhances the accuracy of predictive models, allowing for timely interventions. According to recent estimates, the wearable technology market is expected to reach $60 billion by 2025, indicating a robust growth trajectory. As healthcare providers increasingly leverage these technologies, the predictive disease-analytics market is poised for substantial growth, driven by the demand for more precise and actionable health insights.