Increased Investment in Food Safety

the polypropylene packaging-films market is greatly influenced by the heightened focus on food safety and quality assurance. With rising consumer awareness regarding foodborne illnesses, manufacturers are investing in packaging solutions that ensure product integrity and safety. Polypropylene films are recognized for their barrier properties, which help protect food from contamination and spoilage. In 2025, the food safety packaging segment is projected to grow by 20%, reflecting the industry's commitment to maintaining high safety standards. This trend encourages innovation in the polypropylene packaging-films market, as companies develop advanced films that not only meet safety regulations but also enhance the overall consumer experience.

Rising Demand for Flexible Packaging

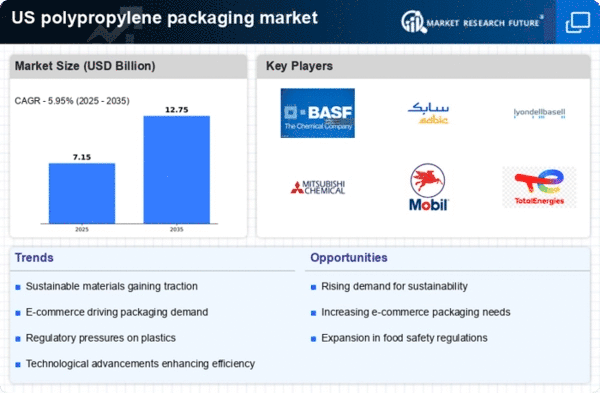

The polypropylene packaging-films market experiences a notable surge in demand for flexible packaging solutions. This trend is driven by the increasing preference for lightweight and versatile packaging options across various sectors, including food and beverage, pharmaceuticals, and consumer goods. Flexible packaging offers advantages such as reduced material usage and enhanced shelf life, which are appealing to manufacturers and consumers alike. In 2025, the flexible packaging segment is projected to account for approximately 40% of the total packaging market in the US, indicating a robust growth trajectory. As companies seek to optimize their packaging strategies, the polypropylene packaging-films market stands to benefit significantly from this shift towards flexible solutions.

Advancements in Recycling Technologies

the polypropylene packaging-films market stands to benefit from advancements in recycling technologies. As sustainability becomes a focal point for consumers and manufacturers alike, the ability to recycle polypropylene films effectively is gaining traction. Innovations in recycling processes are making it feasible to reclaim and reuse polypropylene materials, thereby reducing waste and environmental impact. In 2025, it is anticipated that the recycling rate for polypropylene packaging will increase by 15%, driven by improved technologies and consumer awareness. This development not only supports sustainability initiatives but also enhances the market appeal of polypropylene films, as companies strive to meet eco-friendly standards.

Growth in E-commerce and Online Retail

The expansion of e-commerce and online retail channels has a profound impact on the polypropylene packaging-films market. As more consumers turn to online shopping, the demand for efficient and protective packaging solutions increases. Polypropylene films are favored for their durability and ability to safeguard products during transit. In 2025, the e-commerce sector is expected to contribute to a 25% increase in packaging demand, with polypropylene films playing a crucial role in meeting these needs. This growth presents opportunities for manufacturers to innovate and develop tailored packaging solutions that cater to the unique requirements of online retailers, thereby enhancing their market position.

Consumer Preference for Convenience Products

The polypropylene packaging-films market is influenced by a growing consumer preference for convenience products. As lifestyles become increasingly fast-paced, consumers seek packaging that offers ease of use and portability. Polypropylene films are often utilized in ready-to-eat meals, snacks, and single-serve products, aligning with this trend. In 2025, it is estimated that convenience food packaging will represent around 30% of the overall food packaging market in the US. This shift towards convenience not only drives demand for polypropylene films but also encourages manufacturers to innovate in design and functionality, ensuring that products meet consumer expectations for convenience and quality.