Growth in the E-commerce Sector

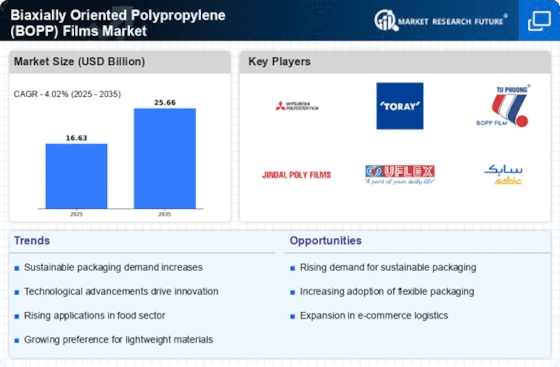

The Biaxially Oriented Polypropylene (BOPP) Films Market is significantly influenced by the rapid expansion of the e-commerce sector. As online shopping continues to gain traction, the need for effective packaging solutions that ensure product safety during transit becomes paramount. BOPP films are increasingly utilized in the packaging of various goods, including electronics, apparel, and food items, due to their durability and protective qualities. In 2025, the e-commerce packaging market is expected to witness a robust growth rate, with BOPP films playing a crucial role in meeting the demands of this evolving landscape. The ability of BOPP films to be customized for branding purposes also aligns with the e-commerce trend, where companies seek to create memorable unboxing experiences for consumers.

Rising Demand for Flexible Packaging

The Biaxially Oriented Polypropylene (BOPP) Films Market is experiencing a notable increase in demand for flexible packaging solutions. This trend is largely driven by the food and beverage sector, which seeks to enhance product shelf life while maintaining quality. In 2025, the flexible packaging segment is projected to account for a substantial share of the overall packaging market, with BOPP films being favored for their lightweight and moisture-resistant properties. The shift towards convenience and on-the-go consumption patterns further propels this demand, as consumers increasingly prefer products that are easy to handle and store. Additionally, the ability of BOPP films to provide excellent printability and clarity makes them an attractive option for brands aiming to enhance their product visibility on retail shelves.

Expanding Applications Across Industries

The Biaxially Oriented Polypropylene (BOPP) Films Market is witnessing an expansion in applications across diverse sectors, including food packaging, textiles, and electronics. The versatility of BOPP films allows them to cater to a wide range of needs, from providing moisture barriers in food packaging to serving as protective layers in electronic devices. In 2025, the market is expected to see increased utilization of BOPP films in non-packaging applications, driven by their unique properties such as high tensile strength and clarity. This diversification not only opens new revenue streams for manufacturers but also enhances the overall market potential for BOPP films. As industries continue to innovate and seek efficient solutions, the role of BOPP films is likely to expand, further solidifying their position in the market.

Technological Innovations in Film Production

Technological advancements in the production of Biaxially Oriented Polypropylene (BOPP) Films are driving the market forward. Innovations such as advanced extrusion techniques and improved stretching processes enhance the mechanical properties and performance of BOPP films. These developments not only increase the strength and clarity of the films but also contribute to their recyclability, aligning with sustainability goals. In 2025, the market is likely to see a rise in the adoption of these innovative production methods, which could lead to a reduction in manufacturing costs and an increase in production efficiency. As manufacturers strive to meet the growing demand for high-quality packaging solutions, the integration of cutting-edge technology in the BOPP films market is expected to play a pivotal role.

Sustainability and Eco-friendly Packaging Solutions

The Biaxially Oriented Polypropylene (BOPP) Films Market is increasingly influenced by the global shift towards sustainability and eco-friendly packaging solutions. Consumers and businesses alike are becoming more environmentally conscious, prompting manufacturers to seek alternatives that minimize environmental impact. BOPP films, known for their recyclability and lower carbon footprint compared to other materials, are gaining traction as a preferred choice for sustainable packaging. In 2025, the demand for eco-friendly packaging is anticipated to grow, with BOPP films positioned as a viable option for brands aiming to enhance their sustainability credentials. This trend not only addresses consumer preferences but also aligns with regulatory pressures for reduced plastic waste, further driving the adoption of BOPP films in various applications.