Increasing Livestock Production

The plasma feed market is experiencing growth due to the rising demand for livestock production in the US. As the population increases, the need for high-quality protein sources, such as meat and dairy, escalates. Plasma feed, known for its nutritional benefits, plays a crucial role in enhancing animal growth and health. In 2025, the livestock sector is projected to expand by approximately 3.5%, driving the demand for plasma feed. This growth is likely to be fueled by the increasing adoption of intensive farming practices, which require efficient feed solutions. Consequently, the plasma feed market is positioned to benefit from this upward trend, as producers seek to optimize feed efficiency and animal performance.

Expansion of the Pet Food Sector

The plasma feed market is also influenced by the expansion of the pet food sector in the US. As pet ownership continues to rise, there is a growing demand for high-quality, nutritious pet food products. Plasma feed, with its rich amino acid profile, is increasingly being incorporated into premium pet food formulations. In 2025, the pet food market is projected to exceed $100 billion, indicating a lucrative opportunity for plasma feed producers. This trend suggests that the plasma feed market will likely see increased diversification in its applications, catering not only to livestock but also to the burgeoning pet food market.

Focus on Animal Health and Welfare

The plasma feed market is significantly influenced by the growing emphasis on animal health and welfare in the US. Consumers are increasingly concerned about the quality of animal products, leading producers to prioritize the health of livestock. Plasma feed is recognized for its ability to improve gut health and immune response in animals, which is essential for maintaining overall well-being. In 2025, it is estimated that the market for animal health products will reach $50 billion, indicating a robust investment in health-focused feed solutions. This trend suggests that the plasma feed market will continue to thrive as producers adopt innovative feeding strategies to enhance animal welfare and meet consumer expectations.

Rising Awareness of Sustainable Practices

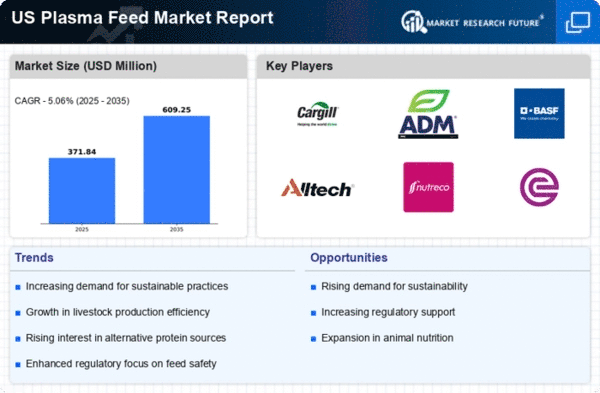

The plasma feed market is benefiting from the increasing awareness of sustainable agricultural practices among producers and consumers alike. As environmental concerns grow, there is a shift towards more sustainable livestock production methods. Plasma feed, derived from by-products, offers a more sustainable alternative to traditional feed sources. In 2025, the market for sustainable feed solutions is projected to grow by 4%, reflecting a broader trend towards eco-friendly practices in agriculture. This shift indicates that the plasma feed market is likely to see heightened demand as producers seek to align with sustainability goals and reduce their environmental footprint.

Technological Innovations in Feed Production

The plasma feed market is being propelled by technological innovations in feed production processes. Advances in processing techniques enhance the nutritional profile and digestibility of plasma feed, making it a more attractive option for livestock producers. In 2025, the feed technology market is expected to reach $30 billion, highlighting the investment in research and development. These innovations not only improve the quality of plasma feed but also increase production efficiency, which is crucial for meeting the growing demand for animal protein. As a result, the plasma feed market is likely to benefit from these advancements, positioning itself as a leader in the evolving landscape of animal nutrition.