Increasing Cyber Threats

The payment security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. In recent years, the number of data breaches has surged, with the Identity Theft Resource Center reporting a 17% increase in breaches in 2023 alone. This alarming trend compels businesses to invest in robust security measures to protect sensitive payment information. As cybercriminals develop more advanced techniques, organizations are prioritizing the implementation of comprehensive security solutions. The payment security market is witnessing a shift towards more resilient technologies. These include encryption and tokenization to safeguard transactions. This growing awareness of cyber threats is likely to drive significant growth in the payment security market, as companies seek to mitigate risks and enhance consumer trust.

Evolving Consumer Expectations

Consumer expectations regarding payment security are evolving rapidly, influencing the payment security market. With the rise of digital transactions, customers increasingly demand secure and seamless payment experiences. According to a recent survey, 70% of consumers express concerns about the security of their payment information, prompting businesses to prioritize security measures. This shift in consumer behavior is driving companies to adopt advanced security technologies, such as multi-factor authentication and real-time fraud detection. As businesses strive to meet these expectations, the payment security market is likely to expand, with organizations investing in innovative solutions to enhance customer confidence and satisfaction. The alignment of security measures with consumer preferences is becoming a critical factor for success in the payment security market.

Shift Towards Digital Payment Solutions

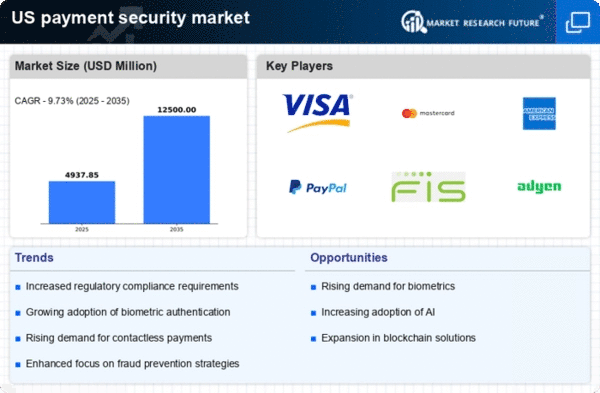

The shift towards digital payment solutions is significantly influencing the payment security market. As more consumers opt for online and mobile payment methods, the need for secure payment processing becomes paramount. According to recent data, digital payment transactions are projected to reach $10 trillion by 2025, underscoring the urgency for robust security measures. This trend is prompting businesses to invest in advanced security technologies to protect against potential threats associated with digital transactions. The payment security market is thus poised for growth, as organizations seek to implement solutions that ensure the safety and integrity of digital payments. This transition towards digital solutions is likely to drive innovation and investment in the payment security market.

Regulatory Landscape and Compliance Requirements

The regulatory landscape surrounding payment security is becoming increasingly stringent, impacting the payment security market. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for businesses handling payment information. Failure to comply can result in hefty fines and reputational damage. As a result, organizations are compelled to invest in security measures that align with these regulations. The payment security market is thus witnessing a surge in demand for compliance-driven solutions, as businesses seek to avoid penalties and enhance their security posture. This regulatory pressure is likely to continue driving growth in the payment security market, as companies prioritize adherence to evolving compliance requirements.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the payment security market. Innovations such as blockchain technology and artificial intelligence are revolutionizing how transactions are secured. For instance, blockchain offers a decentralized approach to transaction verification, enhancing transparency and reducing fraud risks. Additionally, AI-driven security solutions are capable of analyzing vast amounts of transaction data in real-time, identifying anomalies that may indicate fraudulent activity. As these technologies continue to evolve, they are expected to drive significant growth in the payment security market. Businesses are increasingly adopting these advanced solutions to stay ahead of potential threats, indicating a strong trend towards integrating cutting-edge technology into payment security strategies.