Emergence of Cybersecurity Threats

The rise in cybersecurity threats poses a significant challenge to the Mobile Payment Security Software Market. With the increasing sophistication of cyberattacks, including data breaches and identity theft, businesses are compelled to invest in security solutions that can effectively mitigate these risks. The financial sector, in particular, has witnessed a surge in targeted attacks, prompting a heightened focus on mobile payment security. As organizations strive to protect their assets and customer information, the demand for mobile payment security software is expected to escalate, reflecting the urgent need for comprehensive security measures in the industry.

Rise in Mobile Payment Transactions

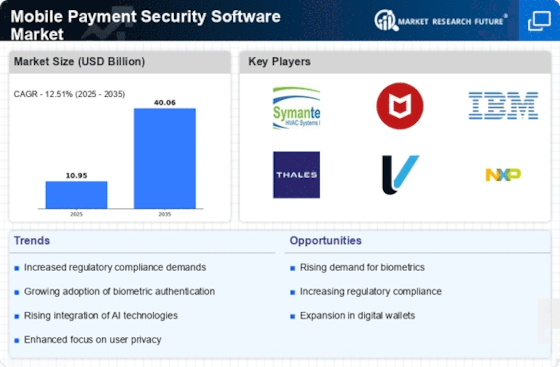

The increasing prevalence of mobile payment transactions is a primary driver for the Mobile Payment Security Software Market. As consumers increasingly adopt mobile wallets and contactless payment methods, the volume of transactions conducted via mobile devices has surged. Reports indicate that mobile payment transactions are expected to reach trillions of dollars in the coming years. This growth necessitates robust security measures to protect sensitive financial information, thereby driving demand for advanced security software solutions. The Mobile Payment Security Software Market is likely to benefit from this trend, as businesses seek to safeguard their customers' data and maintain trust in mobile payment systems.

Consumer Demand for Enhanced Security Features

Consumer demand for enhanced security features is a pivotal factor influencing the Mobile Payment Security Software Market. As consumers become more aware of the risks associated with mobile payments, they are increasingly seeking solutions that offer robust security measures. This shift in consumer behavior is prompting businesses to prioritize security in their mobile payment offerings. The Mobile Payment Security Software Market is likely to experience growth as companies respond to this demand by integrating advanced security features into their payment systems, thereby fostering consumer trust and loyalty.

Regulatory Pressures and Compliance Requirements

Regulatory pressures and compliance requirements are significant drivers for the Mobile Payment Security Software Market. Governments and regulatory bodies are increasingly implementing stringent regulations to protect consumer data and ensure secure payment processes. Compliance with these regulations is essential for businesses operating in the mobile payment space. Failure to adhere to these standards can result in severe penalties and reputational damage. Consequently, organizations are investing in mobile payment security software to ensure compliance and protect their customers' information, thereby fueling growth in the industry.

Technological Advancements in Security Solutions

Technological advancements play a crucial role in shaping the Mobile Payment Security Software Market. Innovations such as biometric authentication, encryption technologies, and blockchain are enhancing the security of mobile payment systems. These advancements not only improve the user experience but also bolster the overall security framework. As businesses adopt these cutting-edge technologies, the demand for mobile payment security software is likely to increase. The integration of advanced security features into mobile payment platforms is essential for maintaining consumer confidence and ensuring the continued growth of the industry.