Rise of DevOps Practices

The adoption of DevOps practices is significantly influencing the open source-services market. Organizations are increasingly integrating development and operations teams to enhance collaboration and streamline software delivery. Open source tools are often at the forefront of this movement, providing the necessary frameworks and resources to support DevOps methodologies. As companies strive for faster deployment cycles and improved software quality, the demand for open source services that facilitate DevOps practices is likely to grow. This trend not only enhances operational efficiency but also positions the open source-services market as a key player in the evolving landscape of software development.

Emphasis on Interoperability

Interoperability is emerging as a critical factor influencing the open source-services market. As organizations adopt diverse technologies, the need for seamless integration between various systems becomes paramount. Open source solutions are often designed with interoperability in mind, enabling businesses to connect disparate systems and enhance overall operational efficiency. This trend is particularly relevant in sectors such as healthcare and finance, where data sharing and system compatibility are essential. The open source-services market is likely to benefit from this emphasis on interoperability, as organizations seek solutions that facilitate collaboration and data exchange across platforms.

Increased Focus on Data Privacy

Data privacy concerns are driving organizations to explore open source-services as a viable alternative to proprietary solutions. With growing regulations surrounding data protection, businesses are prioritizing transparency and control over their data. Open source solutions offer the advantage of allowing organizations to scrutinize the code and ensure compliance with privacy standards. This trend is particularly pronounced in industries such as finance and healthcare, where data security is paramount. As organizations become more aware of the implications of data privacy, the open source-services market is likely to see a surge in demand for solutions that prioritize user data protection.

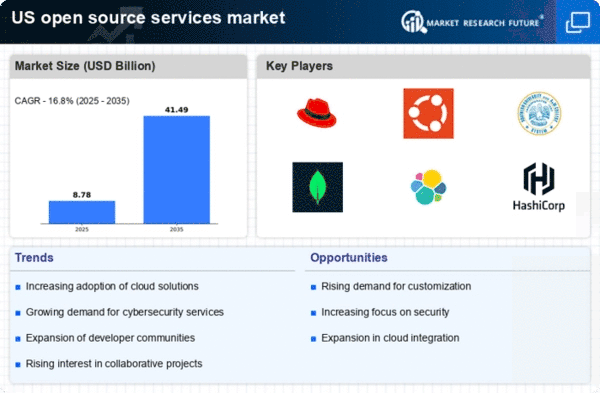

Growing Demand for Customization

The open source-services market is experiencing a notable increase in demand for customization options. Organizations are increasingly seeking tailored solutions that align with their specific operational needs. This trend is driven by the desire for flexibility and adaptability in software solutions, allowing businesses to modify and enhance functionalities without incurring significant costs. According to recent data, approximately 70% of enterprises in the US are prioritizing customized open source solutions to improve efficiency and reduce time-to-market. This growing inclination towards personalized services is likely to propel the open source-services market, as companies recognize the value of bespoke software in achieving competitive advantages.

Shift Towards Cost-Effective Solutions

Cost considerations are becoming a pivotal driver in the open source-services market. Organizations are increasingly turning to open source solutions as a means to reduce software licensing fees and operational costs. The open source model allows businesses to leverage community-driven innovations without the burden of hefty subscription fees associated with proprietary software. Recent statistics indicate that companies utilizing open source services can save up to 30% on software expenditures. This financial incentive is likely to attract more businesses to the open source-services market, fostering a more competitive landscape and encouraging further innovation.