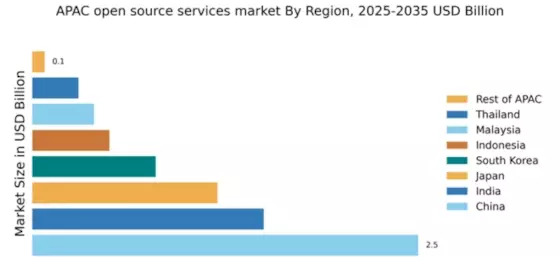

China : Rapid Growth and Innovation Hub

China holds a commanding 2.5% market share in the APAC open source-services sector, driven by robust government support for digital transformation and innovation. The demand for open source solutions is surging, particularly in sectors like finance and telecommunications, as companies seek cost-effective and flexible alternatives. Regulatory policies favoring open standards and the establishment of tech parks are further propelling growth, alongside significant investments in infrastructure and R&D.

India : Vibrant Startups and Innovation

India's open source-services market is valued at 1.5%, reflecting a burgeoning ecosystem fueled by a vibrant startup culture and increasing adoption of cloud technologies. The demand for open source solutions is particularly strong in IT services and education, driven by a young, tech-savvy population. Government initiatives like Digital India are promoting the use of open source software, enhancing accessibility and affordability for businesses.

Japan : Strong Corporate Engagement

Japan's market share stands at 1.2%, characterized by a strong inclination towards technological advancement and corporate adoption of open source solutions. Key growth drivers include the increasing need for data analytics and AI integration in various sectors. The government is actively promoting open source through initiatives aimed at enhancing digital infrastructure and cybersecurity, fostering a conducive environment for innovation.

South Korea : Focus on Smart Technologies

With a market share of 0.8%, South Korea is rapidly adopting open source services, particularly in smart city projects and IoT applications. The demand is driven by government initiatives aimed at digital transformation and the integration of smart technologies in urban planning. The competitive landscape features major players like Red Hat and local startups, creating a dynamic environment for innovation and collaboration.

Malaysia : Government Support and Initiatives

Malaysia's open source-services market is valued at 0.4%, supported by government initiatives promoting digital economy and innovation. The demand for open source solutions is growing in sectors like education and healthcare, driven by cost efficiency and flexibility. The government’s Malaysia Digital Economy Corporation (MDEC) is actively encouraging the adoption of open source technologies, enhancing the local ecosystem.

Thailand : Focus on Digital Transformation

Thailand's market share is at 0.3%, with increasing adoption of open source services driven by digital transformation initiatives across various sectors. The government is promoting open source through policies aimed at enhancing digital literacy and infrastructure. Key cities like Bangkok are emerging as hubs for tech innovation, attracting both local and international players in the open source space.

Indonesia : Youth-Driven Market Dynamics

Indonesia's open source-services market is valued at 0.5%, characterized by a youthful population driving demand for innovative solutions. The government is fostering an open source ecosystem through initiatives aimed at enhancing digital skills and infrastructure. Key sectors include e-commerce and fintech, where open source technologies are increasingly being adopted to improve efficiency and reduce costs.

Rest of APAC : Emerging Markets and Trends

The Rest of APAC holds a modest market share of 0.08%, yet it presents diverse opportunities for open source services. Emerging markets are increasingly recognizing the benefits of open source solutions, driven by cost efficiency and flexibility. Local governments are beginning to adopt policies that support open source initiatives, creating a favorable environment for growth in various sectors.