Rising Demand for Smart Devices

The proliferation of smart devices is significantly influencing the nano gps-chip market. As consumers increasingly adopt smart wearables, smartphones, and IoT devices, the need for accurate and reliable location tracking becomes paramount. In 2025, it is estimated that over 50% of households in the US will own at least one smart device equipped with GPS capabilities. This trend not only enhances user experience but also opens new avenues for applications in fitness tracking, navigation, and location-based services. Consequently, the nano gps-chip market is poised for substantial growth, as manufacturers strive to meet the evolving demands of tech-savvy consumers.

Government Initiatives and Regulations

Government initiatives aimed at enhancing transportation and public safety are significantly impacting the nano gps-chip market. Various federal and state programs are promoting the adoption of GPS technology in public transportation systems and emergency services. For example, the implementation of smart city initiatives encourages the integration of nano gps-chips in urban infrastructure, facilitating better traffic management and emergency response. These regulatory frameworks not only support the growth of the nano gps-chip market but also ensure compliance with safety standards. As a result, the market is expected to witness a steady increase, with an anticipated growth rate of 12% annually through 2025.

Increased Focus on Safety and Security

The growing emphasis on safety and security measures is a key driver for the nano gps-chip market. With rising concerns over personal safety and asset protection, industries are increasingly integrating GPS technology into their products. For instance, automotive manufacturers are incorporating nano gps-chips into vehicles for real-time tracking and theft prevention. Additionally, the healthcare sector is utilizing these chips for patient monitoring and emergency response systems. This heightened focus on safety is expected to propel the nano gps-chip market, with projections indicating a market size of $1.2 billion by the end of 2025, driven by both consumer and regulatory demands.

Technological Advancements in Miniaturization

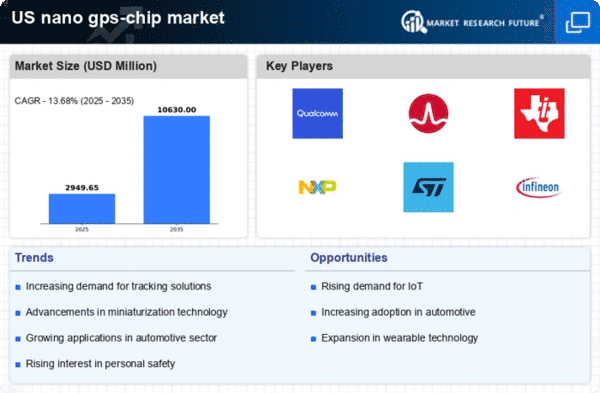

The nano gps-chip market is experiencing a surge due to rapid advancements in miniaturization technologies. As electronic components become smaller and more efficient, the demand for compact GPS solutions increases. This trend is particularly evident in sectors such as automotive and consumer electronics, where space constraints are critical. The integration of nano gps-chips into various devices allows for enhanced functionality without compromising size. In 2025, the market is projected to reach a valuation of approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is indicative of the increasing reliance on precise location tracking in everyday applications, thereby driving the nano gps-chip market forward.

Emerging Applications in Logistics and Supply Chain

The nano gps-chip market is being driven by emerging applications in logistics and supply chain management. As businesses seek to optimize their operations, the demand for precise tracking solutions has surged. Companies are increasingly adopting nano gps-chips to monitor shipments in real-time, enhancing transparency and efficiency. In 2025, it is projected that the logistics sector will account for approximately 30% of the total market share, reflecting a growing recognition of the value of location data in operational decision-making. This trend underscores the potential for the nano gps-chip market to expand as industries leverage technology to improve their supply chain processes.