Rising Geopolitical Tensions

The military imaging-system market is being shaped by rising geopolitical tensions, which compel nations to enhance their defense capabilities. As conflicts and territorial disputes escalate, there is an increasing need for advanced imaging systems to support military operations. The US, in particular, is responding to these challenges by investing in cutting-edge imaging technologies to ensure national security. This heightened focus on defense readiness is expected to result in a robust growth trajectory for the military imaging-system market. The implications of geopolitical dynamics suggest that demand for sophisticated imaging solutions will continue to rise as nations seek to bolster their military capabilities.

Advancements in Sensor Technology

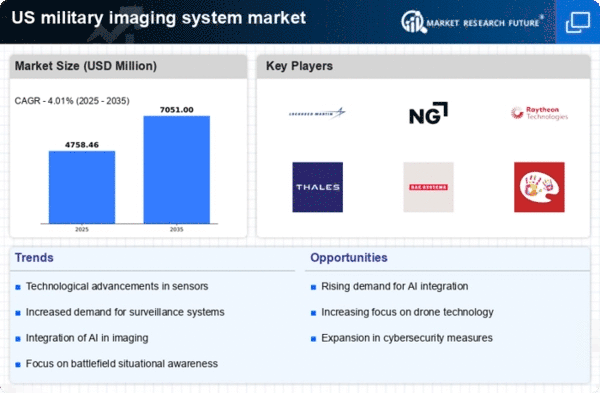

The military imaging-system market is experiencing a surge in advancements in sensor technology, which enhances the capabilities of imaging systems. Innovations such as high-resolution sensors and multispectral imaging are becoming increasingly prevalent. These technologies allow for improved target detection and recognition, which is crucial for military operations. The integration of advanced sensors is expected to drive market growth, with projections indicating a potential increase in market value by over 15% in the next five years. As military forces seek to maintain a technological edge, investments in these advanced sensor systems are likely to escalate, further propelling the military imaging-system market.

Integration of Advanced Data Analytics

The military imaging-system market is increasingly integrating advanced data analytics to enhance operational effectiveness. The ability to process and analyze vast amounts of imaging data in real-time is becoming essential for military decision-making. This integration allows for improved threat assessment and mission planning, which are critical in modern warfare. As military organizations adopt data-driven approaches, the demand for imaging systems equipped with advanced analytics capabilities is likely to grow. This trend indicates a shift towards more intelligent systems that can provide actionable insights, thereby driving the military imaging-system market forward.

Increased Investment in Defense Modernization

The military imaging-system market is significantly influenced by increased investment in defense modernization initiatives. Governments are recognizing the necessity to upgrade aging military equipment and systems to meet contemporary threats. In the US, defense spending is projected to rise by 5% annually, with a substantial portion allocated to modernizing imaging systems. This trend indicates a commitment to enhancing operational capabilities through advanced imaging technologies. As military forces strive to adapt to evolving challenges, the modernization of imaging systems is likely to be a focal point, thereby driving growth in the military imaging-system market.

Growing Demand for Surveillance and Reconnaissance

The military imaging-system market is witnessing a growing demand for surveillance and reconnaissance capabilities. As military operations become more complex, the need for real-time situational awareness is paramount. This demand is reflected in increased defense budgets, with the US allocating approximately $700 billion for defense in 2025, a portion of which is directed towards enhancing imaging systems. The emphasis on intelligence, surveillance, and reconnaissance (ISR) capabilities is likely to drive the adoption of advanced imaging technologies, thereby expanding the military imaging-system market. The trend suggests that military forces are prioritizing investments in systems that provide comprehensive situational awareness.