Increased Awareness and Education

Increased awareness and education regarding migraine disorders are significantly influencing the migraine drugs market. Healthcare providers and organizations are actively promoting understanding of migraine symptoms, triggers, and treatment options. This educational push is leading to earlier diagnosis and treatment initiation, which is crucial for effective management. As patients become more informed, they are more likely to seek medical advice and explore available treatment options. Consequently, this heightened awareness is expected to drive demand for migraine medications, contributing to the growth of the migraine drugs market. The market could see a notable increase in sales as more individuals recognize the importance of addressing their migraine conditions.

Advancements in Pharmaceutical Research

Ongoing advancements in pharmaceutical research are propelling the migraine drugs market forward. The development of novel drug formulations and delivery systems has led to the introduction of more effective treatments. For instance, the emergence of CGRP inhibitors has revolutionized migraine management, providing patients with new options that target specific pathways involved in migraine pathophysiology. The market is witnessing a surge in investment, with pharmaceutical companies allocating substantial resources to research and development. This focus on innovation is expected to yield a variety of new products, enhancing the overall landscape of the migraine drugs market and improving patient outcomes.

Rising Prevalence of Migraine Disorders

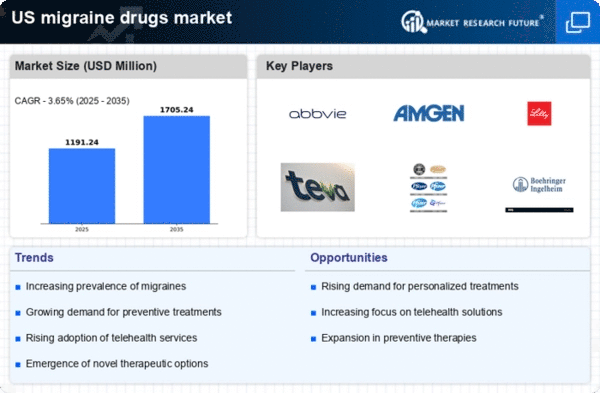

The increasing prevalence of migraine disorders in the US is a primary driver for the migraine drugs market. Recent estimates suggest that approximately 12% of the population experiences migraines, with women being disproportionately affected. This growing patient population necessitates the development and availability of effective migraine treatments. As awareness of migraine disorders rises, more individuals seek medical intervention, thereby expanding the market. The migraine drugs market is projected to grow significantly, with a compound annual growth rate (CAGR) of around 7% over the next few years. This trend indicates a robust demand for innovative therapies and medications tailored to diverse patient needs.

Growing Demand for Preventive Treatments

The growing demand for preventive treatments in the migraine drugs market is reshaping the therapeutic landscape. Many patients are now seeking long-term solutions to manage their migraine conditions rather than relying solely on acute treatments. This shift in patient preference is prompting pharmaceutical companies to focus on developing preventive therapies that can reduce the frequency and severity of migraine attacks. The introduction of new preventive medications, such as monoclonal antibodies, has gained traction among healthcare providers and patients alike. As a result, the migraine drugs market is likely to experience a surge in demand for these innovative preventive options, reflecting a broader trend towards proactive healthcare.

Regulatory Support for New Drug Approvals

Regulatory support for new drug approvals is playing a crucial role in the growth of the migraine drugs market. The US Food and Drug Administration (FDA) has streamlined the approval process for innovative migraine treatments, facilitating quicker access to new therapies for patients. This supportive regulatory environment encourages pharmaceutical companies to invest in research and development, leading to a more diverse range of treatment options. As new drugs receive approval, they contribute to the overall expansion of the migraine drugs market. The potential for faster market entry of effective treatments is likely to enhance competition and drive further innovation within the industry.