Rising Cybersecurity Concerns

In the current landscape, the US Managed Network Services Market is increasingly shaped by rising cybersecurity concerns. Organizations are becoming more aware of the potential threats posed by cyberattacks, leading to a heightened focus on securing their network infrastructures. Managed network service providers are responding to this demand by offering comprehensive cybersecurity solutions that include threat detection, incident response, and compliance management. According to industry reports, nearly 60% of businesses in the US have experienced a cyber incident in the past year, underscoring the urgency for robust security measures. As a result, the integration of cybersecurity services into managed network offerings is not only a competitive differentiator but also a necessity for businesses aiming to protect sensitive data and maintain customer trust.

Shift Towards Remote Work Solutions

The shift towards remote work has profoundly impacted the US Managed Network Services Market. As organizations adapt to flexible work arrangements, there is an increasing need for reliable and secure network solutions that support remote access. Managed network service providers are capitalizing on this trend by offering services that ensure seamless connectivity for remote employees. This includes the implementation of virtual private networks (VPNs), secure access service edge (SASE) solutions, and cloud-based collaboration tools. The demand for these services is expected to grow, with estimates suggesting that remote work could remain a permanent fixture for many organizations. Consequently, managed network services that facilitate remote work are likely to see substantial growth, contributing to the overall expansion of the market.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly influencing the US Managed Network Services Market. These technologies enable service providers to offer enhanced network management solutions that improve performance and reliability. For instance, AI-driven analytics can predict network failures before they occur, allowing for proactive maintenance and minimizing downtime. The adoption of these technologies is expected to increase as organizations recognize the value of data-driven decision-making. Furthermore, the market is anticipated to witness a surge in demand for automated network management solutions, which can streamline operations and reduce the need for manual intervention. This trend is likely to contribute to the overall growth of the managed network services sector, with projections indicating a market size exceeding $50 billion by 2028.

Growing Demand for Network Scalability

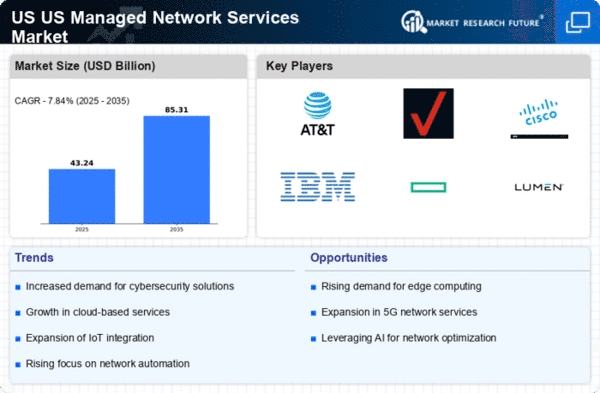

The US Managed Network Services Market is experiencing a notable increase in demand for scalable network solutions. As businesses expand, they require flexible network infrastructures that can adapt to changing needs. This trend is particularly evident among small to medium-sized enterprises (SMEs) that seek to optimize their operational efficiency without incurring substantial capital expenditures. According to recent data, the market for managed network services is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is driven by the necessity for organizations to enhance their network capabilities while maintaining cost-effectiveness. Consequently, service providers are increasingly offering tailored solutions that allow businesses to scale their network resources in alignment with their growth trajectories.

Focus on Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the US Managed Network Services Market. Organizations are increasingly seeking ways to optimize their IT budgets while ensuring high-quality network performance. Managed network services offer a viable solution by allowing businesses to outsource their network management, thereby reducing the need for in-house IT resources. This approach not only lowers operational costs but also enables organizations to focus on their core competencies. Recent studies indicate that companies utilizing managed services can achieve cost savings of up to 30% compared to traditional network management methods. As businesses continue to prioritize cost-effective solutions, the demand for managed network services is expected to rise, further propelling the growth of the industry.