E-commerce Growth

The rapid growth of e-commerce is a driving force behind the logistics automation market. As online shopping continues to gain traction, the demand for efficient and reliable logistics solutions has intensified. E-commerce companies are increasingly adopting automation technologies to manage high order volumes and ensure timely deliveries. In 2025, e-commerce sales in the US are projected to exceed $1 trillion, necessitating advanced logistics capabilities. This surge in demand for automated warehousing, sorting systems, and last-mile delivery solutions is expected to propel the logistics automation market forward, as businesses strive to meet consumer expectations for speed and accuracy.

Technological Advancements

Technological advancements play a pivotal role in shaping the logistics automation market. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming traditional logistics operations. For instance, AI algorithms are being utilized to predict demand patterns, optimize routing, and enhance inventory management. The integration of IoT devices allows for real-time tracking of shipments, improving visibility and accountability. As these technologies continue to evolve, they are expected to drive substantial growth in the logistics automation market. Industry reports suggest that the market could reach a valuation of $50 billion by 2027, underscoring the impact of technological progress on logistics efficiency.

Rising Demand for Efficiency

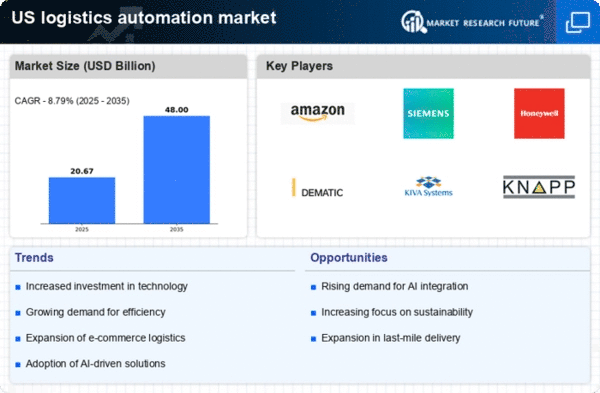

The logistics automation market is experiencing a notable surge in demand for efficiency across supply chains. Companies are increasingly seeking to streamline operations, reduce lead times, and enhance overall productivity. According to recent data, logistics costs in the US account for approximately 8% of GDP, highlighting the need for optimization. Automation technologies, such as warehouse management systems and automated guided vehicles, are being adopted to minimize human error and improve throughput. This trend indicates that businesses are prioritizing investments in logistics automation to remain competitive in a rapidly evolving market. As a result, the logistics automation market is projected to grow significantly, driven by the imperative to achieve operational excellence.

Labor Shortages and Workforce Challenges

The logistics automation market is significantly influenced by labor shortages and workforce challenges. The US is currently facing a shortage of skilled labor in the logistics sector, which has prompted companies to explore automation solutions. With an estimated 1.4 million truck driver vacancies projected by 2026, businesses are increasingly turning to automated systems to fill the gap. Automation not only addresses labor shortages but also enhances safety and reduces operational risks. Consequently, the logistics automation market is likely to expand as organizations invest in technologies that mitigate workforce challenges and ensure continuity in operations.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical factors influencing the logistics automation market. The US government has implemented stringent regulations regarding transportation safety, environmental impact, and labor practices. Companies are compelled to adopt automated solutions to ensure compliance with these regulations while maintaining operational efficiency. Automation technologies can help organizations adhere to safety protocols, reduce accidents, and minimize environmental footprints. As regulatory pressures continue to mount, the logistics automation market is likely to see increased investment in technologies that facilitate compliance and enhance safety measures across the supply chain.