Increased Investment in R&D

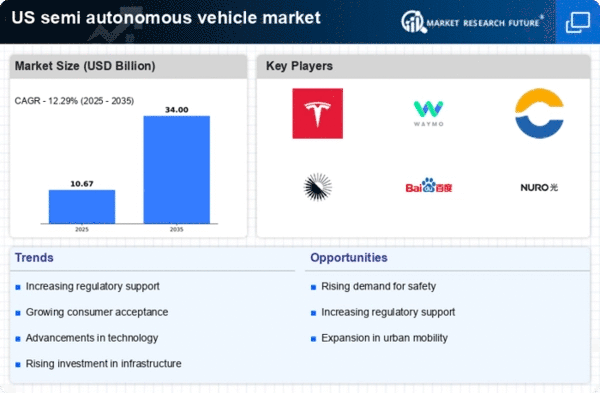

The semi autonomous-vehicle market is experiencing a surge in investment directed towards research and development. Major automotive manufacturers and tech companies are allocating substantial budgets, often exceeding $10 billion annually, to innovate and enhance semi autonomous technologies. This influx of capital is fostering advancements in artificial intelligence, sensor technology, and machine learning, which are crucial for the development of safer and more efficient vehicles. As a result, the market is likely to witness accelerated growth, with projections indicating a compound annual growth rate (CAGR) of around 20% over the next five years. This investment trend not only supports technological advancements but also encourages collaboration between automotive and technology sectors, further propelling the semi autonomous-vehicle market forward.

Urbanization and Traffic Congestion

The ongoing trend of urbanization and increasing traffic congestion in major US cities is driving the semi autonomous-vehicle market. As urban populations swell, the demand for efficient transportation solutions intensifies. Semi autonomous vehicles offer the potential to alleviate traffic congestion through optimized routing and reduced human error. Studies suggest that implementing semi autonomous technology could decrease traffic accidents by up to 30%, thereby enhancing overall traffic flow. Furthermore, the semi autonomous-vehicle market is likely to benefit from urban planning initiatives that prioritize smart transportation systems. As cities evolve to accommodate growing populations, the integration of semi autonomous vehicles into public transport and personal mobility solutions appears to be a promising avenue for addressing urban mobility challenges.

Environmental Sustainability Initiatives

The push for environmental sustainability is increasingly influencing the semi autonomous-vehicle market. With growing awareness of climate change and the need for reduced carbon emissions, there is a notable shift towards electric semi autonomous vehicles. Government incentives, such as tax credits and rebates, are encouraging consumers to adopt greener technologies. In 2025, it is estimated that electric vehicles, including semi autonomous models, will account for approximately 25% of new vehicle sales in the US. This transition not only supports environmental goals but also aligns with the automotive industry's commitment to sustainability. As manufacturers invest in eco-friendly technologies, the semi autonomous-vehicle market is poised for growth, driven by both consumer preferences and regulatory frameworks aimed at reducing environmental impact.

Growing Demand for Enhanced Safety Features

Consumer demand for enhanced safety features is a significant driver in the semi autonomous-vehicle market. As road safety remains a pressing concern, the integration of advanced driver-assistance systems (ADAS) is becoming increasingly vital. Features such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control are gaining traction among consumers. According to recent surveys, approximately 70% of potential buyers express a preference for vehicles equipped with semi autonomous capabilities, indicating a strong market inclination towards safety-enhancing technologies. This growing demand is prompting manufacturers to prioritize the development of semi autonomous vehicles, thereby stimulating growth in the semi autonomous-vehicle market. The emphasis on safety not only addresses consumer concerns but also aligns with regulatory pressures for improved vehicle safety standards.

Advancements in Connectivity and Infrastructure

the market is being propelled by advancements in connectivity and infrastructure. The development of smart city initiatives and vehicle-to-everything (V2X) communication technologies is enhancing the operational capabilities of semi autonomous vehicles. These innovations facilitate real-time data exchange between vehicles, infrastructure, and other road users, improving safety and efficiency. As of November 2025, approximately 40% of urban areas in the US are implementing smart infrastructure projects, which are expected to support the integration of semi autonomous vehicles into everyday traffic. This interconnected ecosystem not only enhances the driving experience but also fosters public acceptance of semi autonomous technologies. Consequently, the semi autonomous-vehicle market is likely to expand as infrastructure evolves to accommodate these advanced vehicles.