Rising Focus on Quality Control

Quality control remains a pivotal concern within the laboratory automation market, as laboratories strive to meet stringent regulatory standards. The implementation of automated systems facilitates consistent and reproducible results, which are essential for compliance with industry regulations. As laboratories increasingly adopt automation to enhance their quality control measures, the market is expected to witness substantial growth. In fact, it is estimated that the demand for automated quality control solutions will account for nearly 30% of the total market by 2026. This trend underscores the importance of reliability and accuracy in laboratory operations, driving investments in automation technologies that ensure high-quality outputs. Consequently, the laboratory automation market is likely to expand as organizations prioritize quality assurance in their processes.

Technological Advancements in Automation

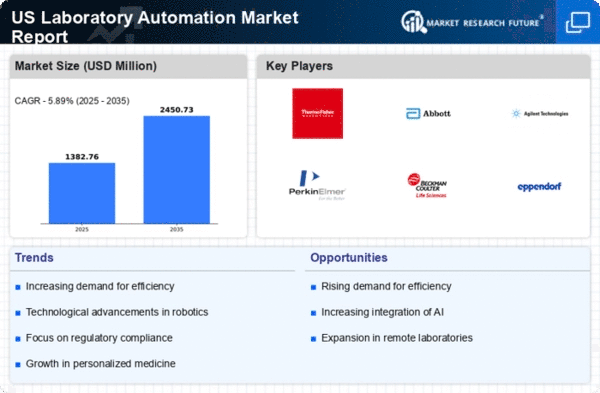

The laboratory automation market is experiencing a surge in technological advancements that enhance operational efficiency and accuracy. Innovations such as robotics, liquid handling systems, and automated sample analysis are becoming increasingly prevalent. These technologies not only streamline workflows but also reduce human error, which is critical in laboratory settings. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years, driven by these advancements. As laboratories seek to improve throughput and reliability, the adoption of automated solutions is likely to increase, thereby propelling the laboratory automation market forward. Furthermore, The integration of advanced software solutions for data management and analysis is also contributing to this growth. Laboratories aim to optimize their processes and enhance productivity.

Growing Need for High-Throughput Screening

The laboratory automation market is witnessing a growing need for high-throughput screening (HTS) solutions, particularly in drug discovery and development. HTS allows laboratories to conduct large-scale experiments efficiently, significantly reducing the time required to identify potential drug candidates. As pharmaceutical companies and research institutions aim to accelerate their drug development processes, the demand for automated HTS systems is expected to rise. Current estimates suggest that the HTS market could reach $5 billion by 2027, with automation playing a crucial role in achieving these efficiencies. This trend indicates that the laboratory automation market will continue to expand as organizations seek to leverage automation for faster and more effective screening processes.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of growth in the laboratory automation market. As organizations seek to innovate and develop new products, the demand for automated solutions that can accelerate research processes is on the rise. R&D departments are increasingly adopting automation technologies to enhance their capabilities, reduce time-to-market, and improve data accuracy. Reports indicate that R&D spending in the life sciences sector alone is expected to exceed $200 billion by 2026, with a substantial portion allocated to automation solutions. This trend suggests that as laboratories invest more in R&D, the laboratory automation market will likely benefit from increased demand for advanced automation tools that support complex research activities.

Emphasis on Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are increasingly becoming focal points within the laboratory automation market. Laboratories are under constant pressure to reduce operational costs while maintaining high-quality outputs. Automation technologies offer a viable solution by minimizing labor costs and maximizing resource utilization. It is projected that automation can reduce operational costs by up to 25% in certain laboratory settings. As organizations recognize the financial benefits of implementing automated systems, the laboratory automation market is likely to experience robust growth. This emphasis on cost efficiency not only drives the adoption of automation but also encourages laboratories to explore innovative solutions that enhance productivity and reduce waste.