Medical Automation Market Summary

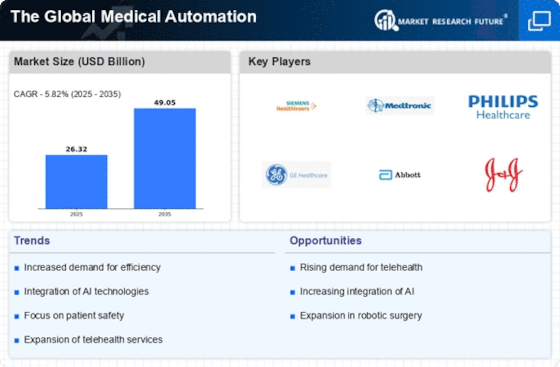

As per Market Research Future analysis, The Global Medical Automation Market Size was estimated at 26.32 USD Billion in 2024. The medical automation industry is projected to grow from 27.85 USD Billion in 2025 to 49.05 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.82% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Medical Automation Market is poised for substantial growth driven by technological advancements and increasing healthcare demands.

- The rise of robotic surgery is transforming surgical procedures, enhancing precision and patient outcomes.

- Integration of artificial intelligence is streamlining operations and improving diagnostic accuracy across healthcare settings.

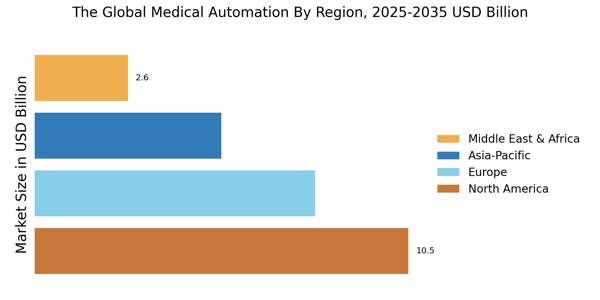

- Telemedicine expansion is facilitating remote patient monitoring and consultations, particularly in the Asia-Pacific region.

- Increasing demand for efficiency and advancements in robotics are key drivers propelling growth in the diagnostic and monitoring automation segment.

Market Size & Forecast

| 2024 Market Size | 26.32 (USD Billion) |

| 2035 Market Size | 49.05 (USD Billion) |

| CAGR (2025 - 2035) | 5.82% |

Major Players

Siemens Healthineers (DE), Medtronic (US), Philips Healthcare (NL), GE Healthcare (US), Abbott Laboratories (US), Johnson & Johnson (US), Baxter International (US), Roche Diagnostics (CH), Boston Scientific (US), Stryker Corporation (US)