Rising Demand for Smart Devices

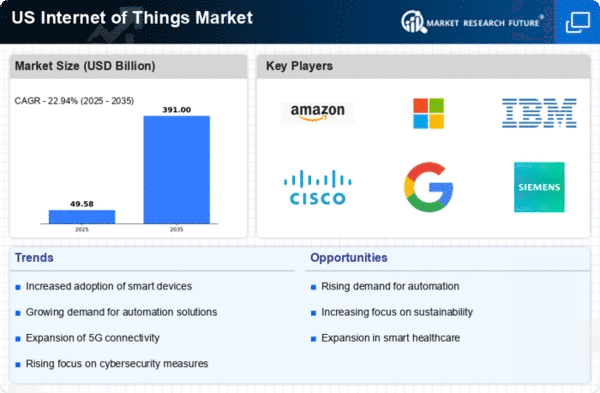

The increasing consumer demand for smart devices is a pivotal driver in the internet of-things market. As households and businesses seek to enhance efficiency and convenience, the adoption of smart appliances, wearables, and connected devices has surged. In 2025, it is estimated that the market for smart home devices alone will reach approximately $80 billion in the US. This trend indicates a growing inclination towards automation and connectivity, which is likely to propel the internet of-things market further. The integration of these devices into daily life not only improves user experience but also fosters a culture of innovation, encouraging manufacturers to develop more advanced solutions. Consequently, the proliferation of smart devices is expected to significantly influence the trajectory of the internet of-things market, driving investment and technological advancements.

Growing Awareness of Energy Efficiency

The rising awareness of energy efficiency among consumers and businesses is driving the internet of-things market. As energy costs continue to rise, there is a growing demand for solutions that can optimize energy consumption. IoT technologies enable real-time monitoring and management of energy usage, allowing users to make informed decisions. In 2025, it is estimated that the market for energy management systems will reach $20 billion in the US. This trend reflects a broader commitment to sustainability and environmental responsibility, which is likely to influence purchasing decisions. The focus on energy efficiency not only benefits consumers financially but also aligns with regulatory initiatives aimed at reducing carbon footprints, thereby propelling the internet of-things market forward.

Expansion of Industrial IoT Applications

The expansion of industrial IoT applications is a key driver in the internet of-things market. Industries such as manufacturing, logistics, and agriculture are increasingly adopting IoT solutions to enhance operational efficiency and productivity. In 2025, the industrial IoT market is projected to reach $50 billion in the US, driven by the need for automation and data-driven decision-making. These applications enable real-time monitoring of equipment, predictive maintenance, and supply chain optimization, which are essential for maintaining competitiveness. As industries recognize the value of IoT technologies in streamlining operations and reducing costs, the demand for such solutions is expected to grow, further propelling the internet of-things market.

Advancements in Connectivity Technologies

The evolution of connectivity technologies, such as 5G and Wi-Fi 6, plays a crucial role in shaping the internet of-things market. These advancements facilitate faster data transmission and improved network reliability, which are essential for the seamless operation of connected devices. In 2025, the 5G network is projected to cover over 50% of the US population, enabling a more robust infrastructure for IoT applications. This enhanced connectivity allows for real-time data processing and communication, which is vital for applications in sectors like healthcare, transportation, and smart cities. As connectivity technologies continue to advance, they are likely to unlock new opportunities for innovation and growth within the internet of-things market, making it a key driver of market expansion.

Increased Investment in Smart Infrastructure

The growing emphasis on smart infrastructure is a significant driver of the internet of-things market. Governments and private sectors are increasingly investing in smart city initiatives, which integrate IoT technologies to improve urban living. In 2025, it is anticipated that investments in smart infrastructure will exceed $100 billion in the US. This includes the deployment of smart traffic management systems, energy-efficient buildings, and enhanced public safety measures. Such initiatives not only aim to optimize resource usage but also enhance the quality of life for residents. The integration of IoT solutions into infrastructure projects is expected to create a ripple effect, stimulating further growth in the internet of-things market as more cities adopt these technologies to address urban challenges.